Global Minimum Tax Us

The new US. Before the Biden proposal the Paris-based organisation said a global minimum rate could boost the global tax take by US100 billion.

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Recently Treasury Secretary Janet Yellen unveiled a new proposal to implement a global minimum tax on corporations to prevent these vast businesses from shopping around for the lowest rate.

Global minimum tax us. Council of Economic Advisers chair Cecilia Rouse pushed for a global minimum tax on corporations to counteract President Bidens proposed corporate tax rate hike. The Biden administration wants to raise the US. A global minimum tax for companies aims to put a stop to this tax trick.

23 hours agoGlobal minimum tax of 125 could raise 100 billion. The effective US. The global minimum tax would apply to companies foreign earnings meaning that countries could still establish their own corporate tax rate at.

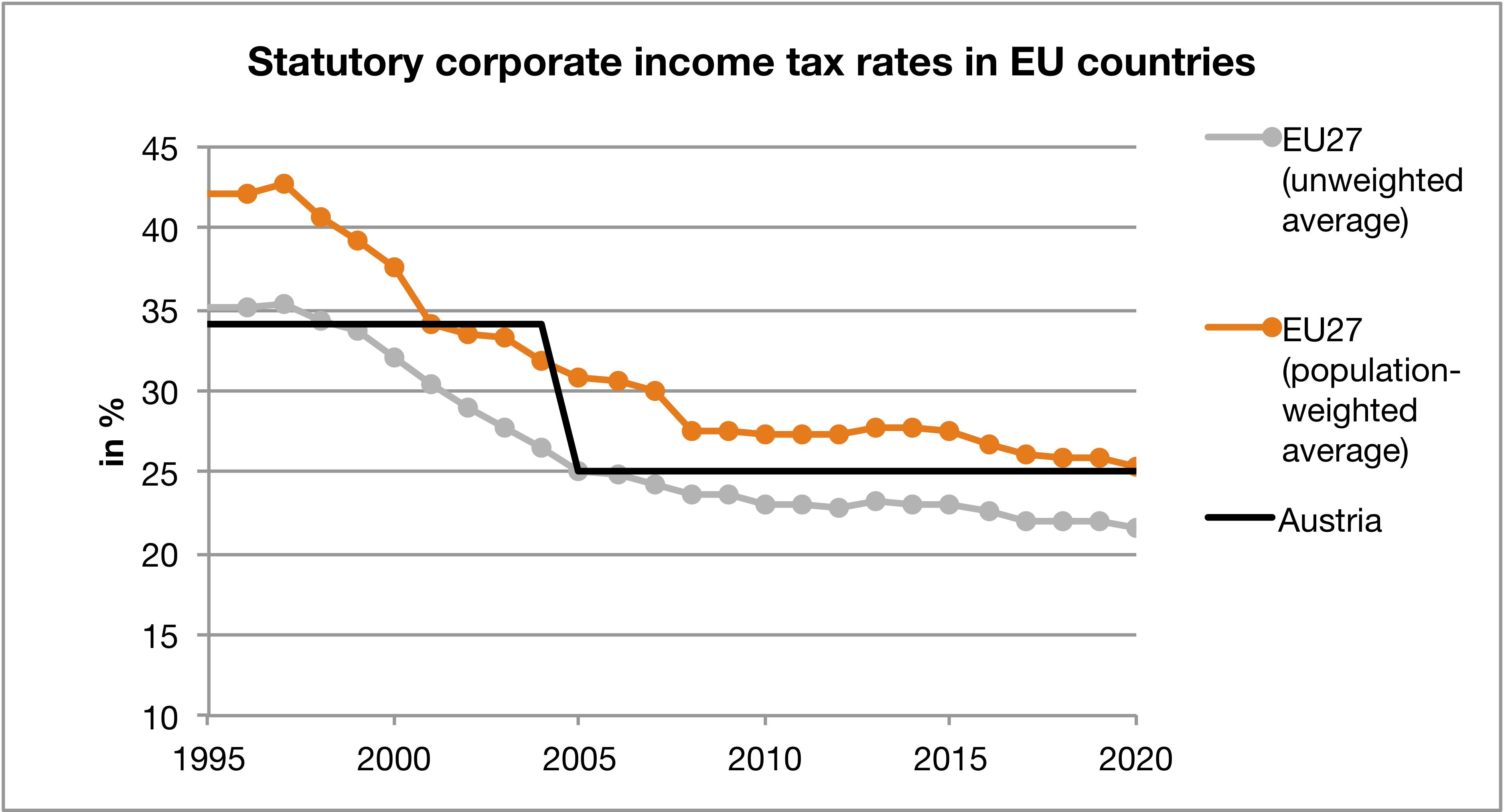

Federal tax rate had fallen from about 44 percent to closer to 29 percent before the tax law was passed according to Goldman Sachs research. It is being proposed that the race to the bottom for corporate tax rates be reversed. Corporate offshore minimum tax in 2017.

The global minimum push is coming alongside the Bidens administration to raise taxes at home. A minimum corporate tax rate around 21 would be well above the 125 figure that has been under discussion at the OECD level said Elke Asen a. Under proposals unveiled today as part of a new 2tn infrastructure plan the White House said the Presidents tax reforms would increase the minimum tax on US corporations overseas earnings to 21.

Treasury Secretary Janet Yellen has called for a minimum corporate income tax that would be shared by countries all over the world. The US Treasury building in Washington. Yellens support for a global tax minimum is largely tied to the new US23 trillion infrastructure plan being proposed by President Joe Biden which has faced Republican criticism for its size.

13 hours ago4D Chess. The idea is that if there is a unified minimum tax all over the world corporations will no longer be able to shift their profits to countries without taxes. In 2017 the US cut its corporate tax rate to 21 from 35.

This would be in addition to raising the corporate tax rate to 28. President Joe Bidens infrastructure proposal called the American Jobs Plan would increase the minimum tax on US corporations to 21 and. The US Treasurys call for a global minimum tax has received global endorsement.

A tax rate of 125 percent is under discussion. On April 5 United States Treasury Secretary Janet Yellen gave her full-throated support to the introduction of a minimum global corporate income tax in a virtual speech she gave to the Chicago. US Treasury Secretary Janet Yellen followed up last week with calls for a global minimum corporate tax of 21 per cent for multinational corporations signaling that a collective international.

The Global Intangible Low-Taxed Income or GILTI the tax rate was only 105 - half the domestic corporate tax rate. Corporate tax rate to 28 so it has proposed a global minimum of 21 - double the rate on the. The organizations calculations rely on most countries adopting a 125 minimum rate and the United States retaining its current global minimum tax.

While in principle it is sound policy to remove preferential rate structures for companies one must inquire into what stakeholders mean when they say that a company must pay its. This would apply to the largest and most profitable businesses numbering around 100 with the suggestion that the minimum rate to be applied to be 21 and be. In a speech to the Chicago Council on Global Affairs US.

A global minimum tax establishes a system under which a company from a specific country will pay at least a certain percentage of its profits in taxes. That figure would be significantly greater if the US. The Trump administration took a first stab at capturing revenues lost to tax havens with a US.

1 The decrease of corporate tax rates around the world has led to what Yellen has described as a 30-year race to the bottom which has led to tax. Secretary of Treasury Janet Yellen has garnered this weeks tax spotlight with her support and request for the world to support a minimum global corporate income tax.

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

Janet Yellen Global Tax Cartel For Biden National Review

Janet Yellen Global Tax Cartel For Biden National Review

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg) Countries With The Highest Lowest Corporate Tax Rates

Countries With The Highest Lowest Corporate Tax Rates

Yellen Pushes Global Minimum Tax As White House Eyes New Spending Plan The Washington Post

Yellen Pushes Global Minimum Tax As White House Eyes New Spending Plan The Washington Post

Janet Yellen Calls For Single Minimum Corporate Tax Around The World Npr

Janet Yellen Calls For Single Minimum Corporate Tax Around The World Npr

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Us Offers New Plan In Global Corporate Tax Talks Financial Times

The Push For A Global Minimum Corporate Tax Rate News Article

The Push For A Global Minimum Corporate Tax Rate News Article

Can A Global Minimum Corporate Tax Be A Game Changer For India

Can A Global Minimum Corporate Tax Be A Game Changer For India

How Did The Tcja Change The Amt Tax Policy Center

How Did The Tcja Change The Amt Tax Policy Center

Us Treasury S Yellen Calls For Global Minimum Corporate Tax

Us Treasury S Yellen Calls For Global Minimum Corporate Tax

Can A Global Minimum Corporate Tax Be A Game Changer For India

Can A Global Minimum Corporate Tax Be A Game Changer For India

Yellen Pushes Global Minimum Tax As White House Eyes New Spending Plan The Washington Post

Yellen Pushes Global Minimum Tax As White House Eyes New Spending Plan The Washington Post

The Push For A Global Minimum Corporate Tax Rate News Article

The Push For A Global Minimum Corporate Tax Rate News Article

Sources Of Government Revenue In The United States Tax Foundation

Sources Of Government Revenue In The United States Tax Foundation

How Would A Global Minimum Tax Work And Why Is It Needed Tax Havens The Guardian

How Would A Global Minimum Tax Work And Why Is It Needed Tax Havens The Guardian

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Janet Yellen Calls For Global Minimum Corporate Tax Financial Times

Janet Yellen Calls For Global Minimum Corporate Tax Financial Times

How Would A Global Minimum Tax Work And Why Is It Needed Tax Havens The Guardian

How Would A Global Minimum Tax Work And Why Is It Needed Tax Havens The Guardian

Post a Comment for "Global Minimum Tax Us"