Global Minimum Corporate Tax Oecd

With a global minimum rate of 15 in effect Country A would top up the tax and collect another 4 of the companys profit from Country B -- representing the difference between Country Bs. Before the Biden proposal the Organisation for Economic Cooperation and Development OECD said a global minimum rate could boost the global tax take by US100 billion.

Total Tax Revenue Us Taxes Are Low Relative To Those In Other Developed Countries In 2014 Us Taxes At All Le Gross Domestic Product Developing Country Us Tax

Total Tax Revenue Us Taxes Are Low Relative To Those In Other Developed Countries In 2014 Us Taxes At All Le Gross Domestic Product Developing Country Us Tax

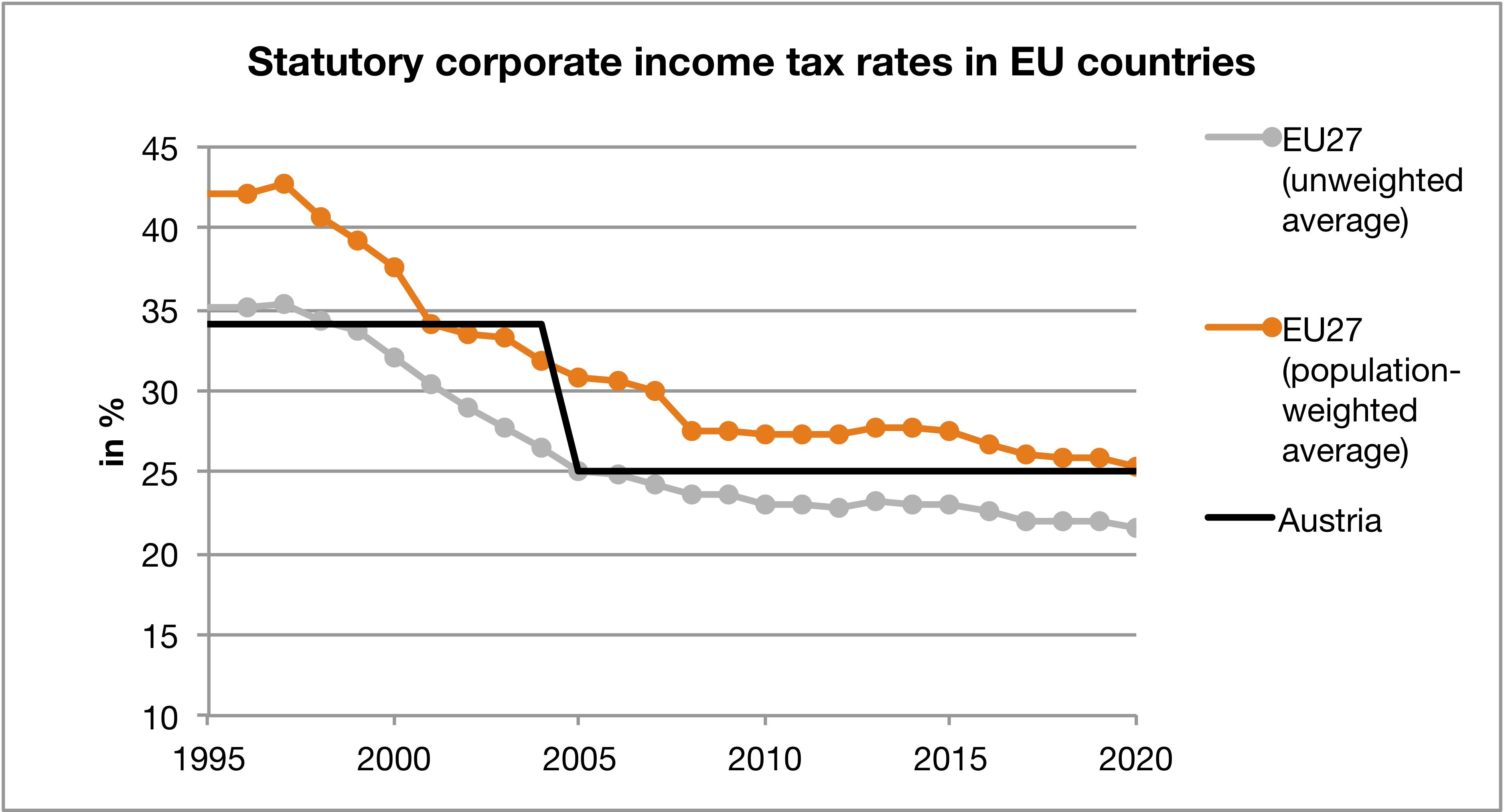

Over the past 35 years the average corporate tax rate worldwide has been more than halved falling from 49 percent in 1985 to 23 percent in 2019.

Global minimum corporate tax oecd. The global minimum tax would apply to companies foreign earnings meaning that countries could still establish their own corporate tax rate at home. The G-20 is gearing up for a meeting to. A global minimum corporate tax would set the same minimum tax rate for companies globally regardless of their operational locations.

President Joe Biden would raise the corporate tax rate to 28 with the Made In America Tax Plan which calls for a 21 global minimum tax. One focus of the OECD. 1 day agoLaw360 May 14 2021 645 PM EDT -- Despite years of fine-tuning the Organization for Economic Cooperation and Developments proposals to overhaul the global tax.

OECD Minimum Tax Rate Hurts the US. The Biden administration wants to raise the US. The OECD Secretariat has recently released for consultation further details of a draft proposal entitled Global Anti-Base Erosion or GloBE which would in effect establish a global minimum corporate income tax rate for certain multinational businesses refer to.

Council of Economic Advisers chair Cecilia Rouse pushed for a global minimum tax on corporations to counteract President Bidens proposed corporate tax rate hike. The tax rate alongside the proposal to tax businesses solely based on their locations of profit are the two core pillars of the Base Erosion and Profit Shifting BEPS initiative1. Companies profits from their global operations in.

President Joe Bidens proposal to set a minimum global corporation tax at 21 is gaining momentum with the official running international. Corporate tax proposal includes an increase to the US. Multinational corporations can easily avoid corporate.

The new US. Corporate tax rate to 28 so it has proposed a global minimum of 21 - double the rate on the. This would apply to the largest and most profitable businesses numbering around 100 with the suggestion that the minimum rate to be applied to be 21 and be.

Minimum tax that was included in Trumps tax law from 105 to 21. European Union should support OECD United States and others in adopting the minimum level. A global minimum rate for corporate tax would decrease tax competition which is detrimental to public economies and causes inequality.

The OECD last month proposed that governments should tear up a century of tax history by allowing countries to tax operations in their jurisdiction even if companies have no physical presence. The message reinforced President Joe Bidens recent call for raising the minimum tax already in place on US. Last year the Organization for Economic Cooperation and Development OECD announced its two-pillar proposal to pursue the goals of transferring tax rights between nations targeting profits of larger companies and multinational corporations and instituting a cross-border minimum tax rate.

The organizations calculations rely on most countries adopting a 125 minimum rate and the United States retaining its current global minimum tax regime which includes a. Plan envisages a 21 minimum corporate tax rate coupled with eliminating exemptions on income from countries that do not enact a minimum tax to. Secretary of Treasury Janet Yellen has garnered this weeks tax spotlight with her support and request for the world to support a minimum global corporate income tax.

The Push For A Global Minimum Corporate Tax Rate News Article

The Push For A Global Minimum Corporate Tax Rate News Article

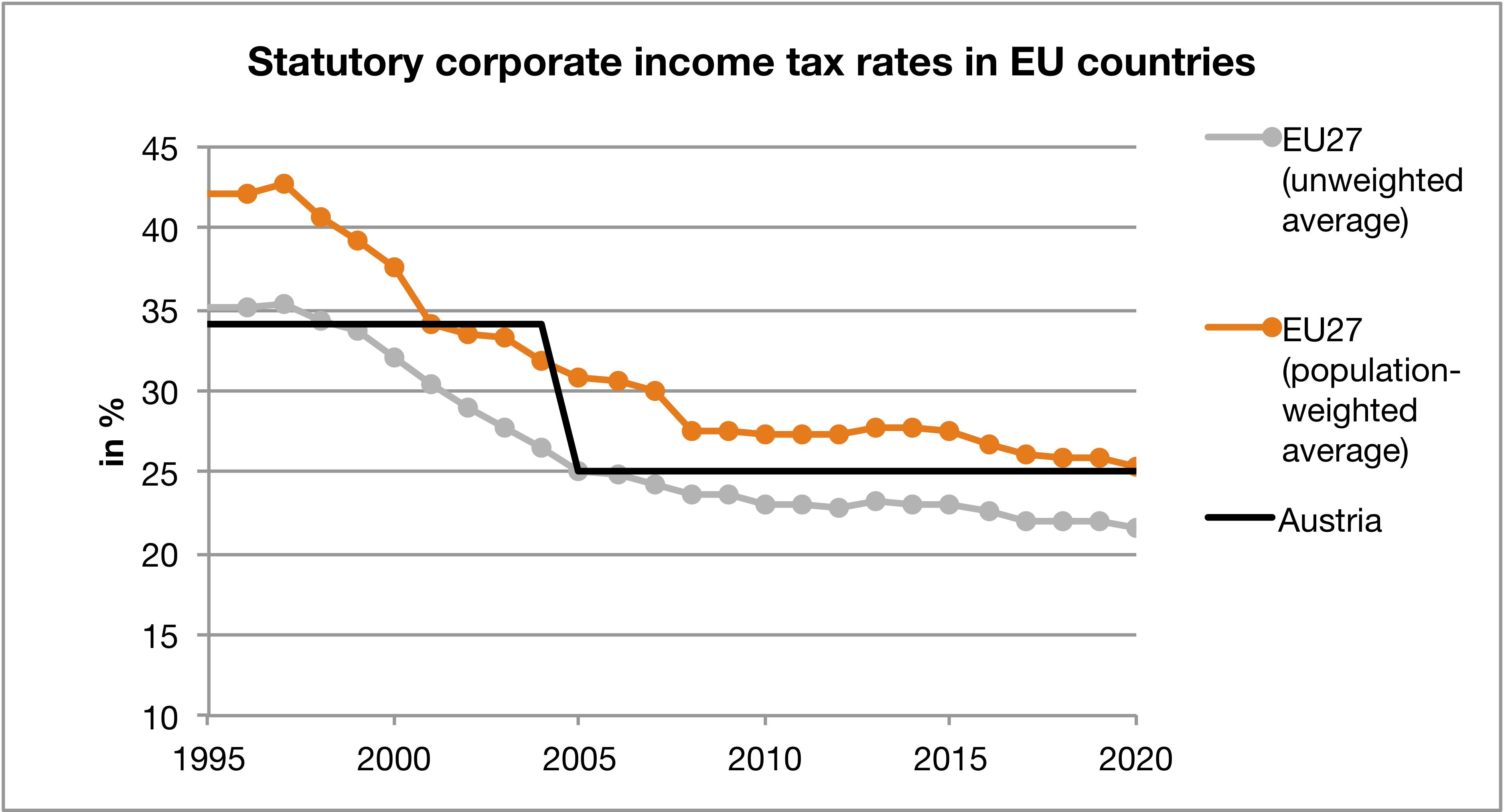

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Around The World Covid Prompts New Look At Company Taxes Reuters

Around The World Covid Prompts New Look At Company Taxes Reuters

Corporate Tax Statistics Database Oecd

Corporate Tax Statistics Database Oecd

Https Www Oecd Org Tax Oecd Tax Talks Presentation May 2020 Pdf

Https Osf Io Preprints Socarxiv J3p48 Download

Health Expenditure As Share Of Gdp By Country Statista

Health Expenditure As Share Of Gdp By Country Statista

Corporate Tax Statistics Database Oecd

Corporate Tax Statistics Database Oecd

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Around The World Covid Prompts New Look At Company Taxes Reuters

Around The World Covid Prompts New Look At Company Taxes Reuters

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

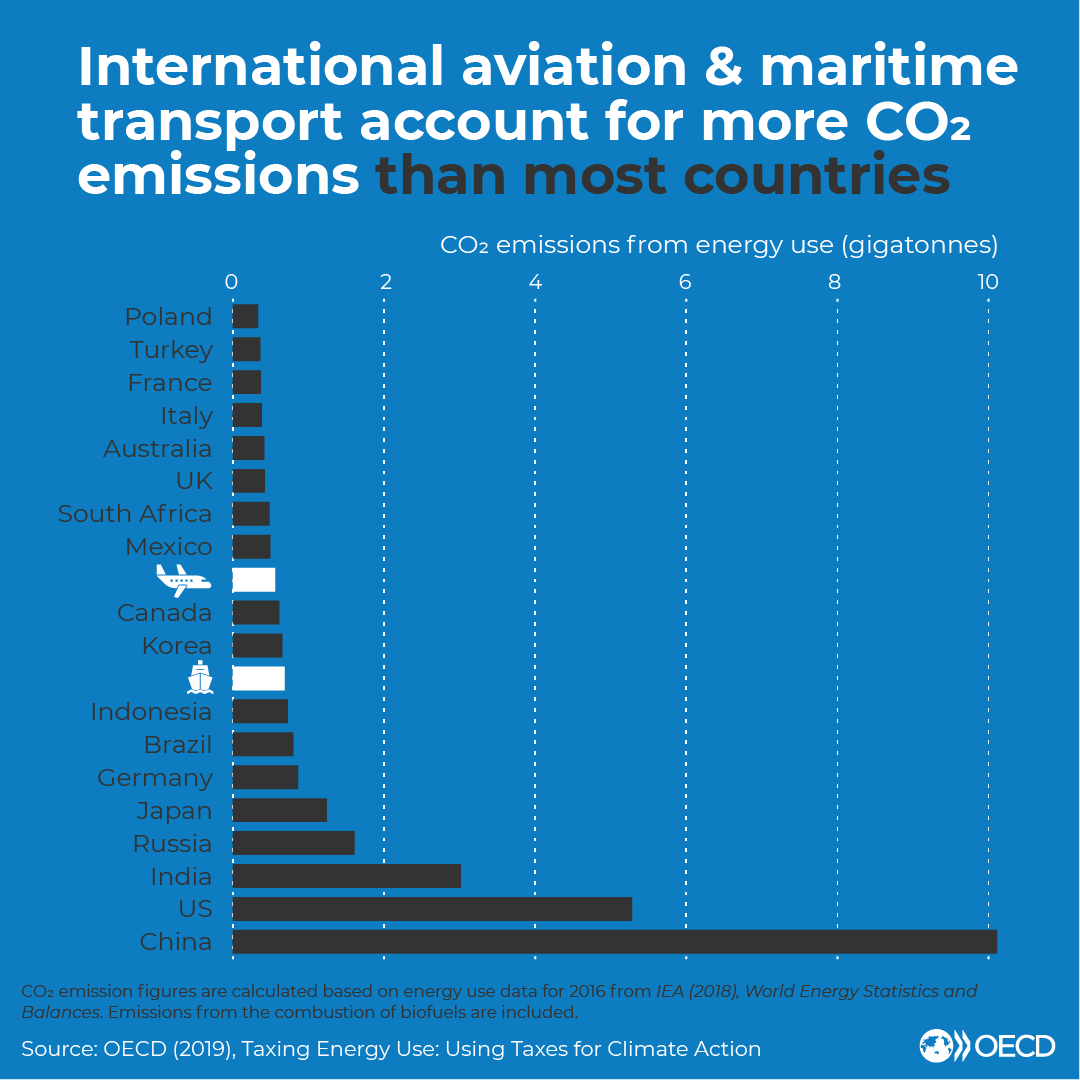

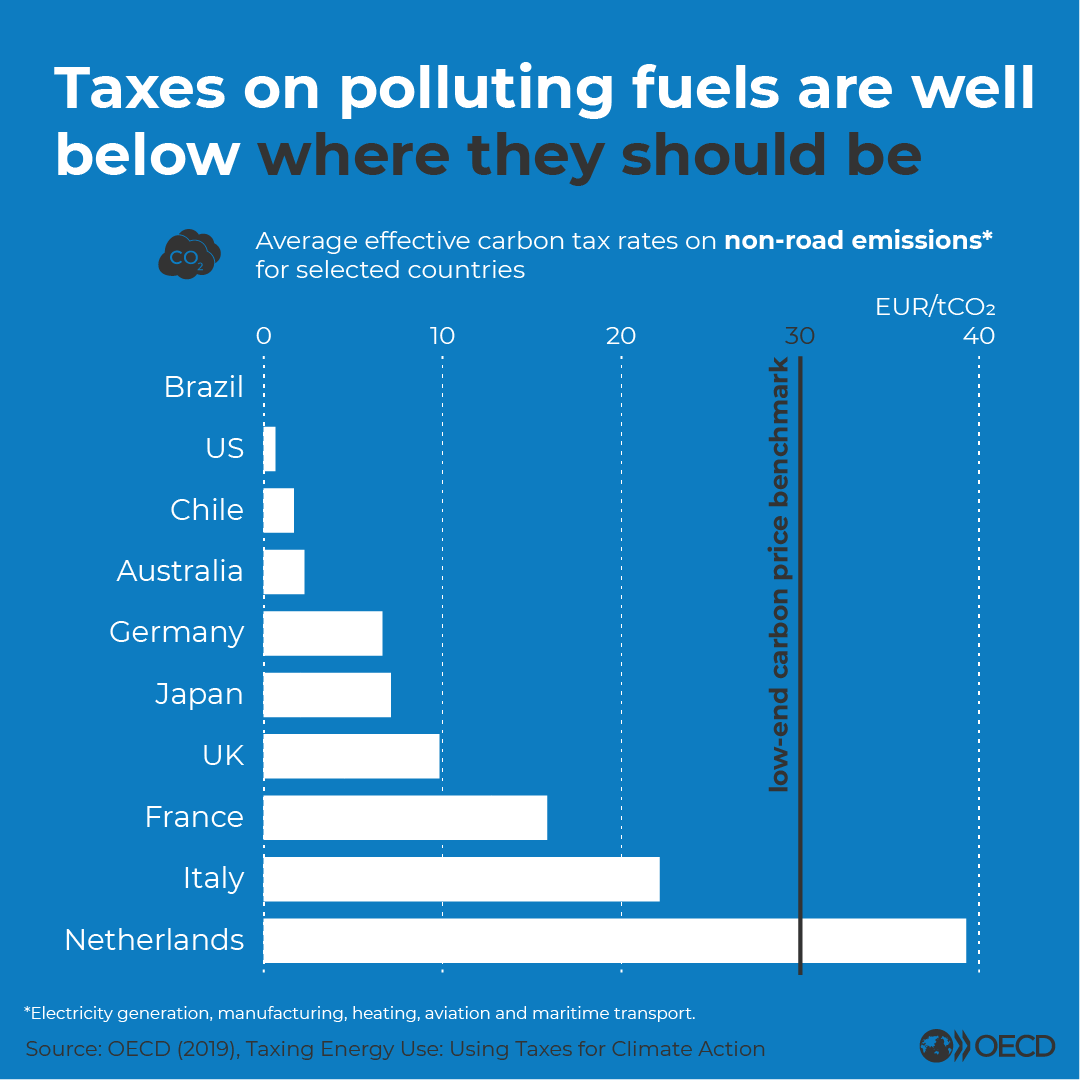

Taxing Energy Use 2019 Using Taxes For Climate Action En Oecd

Taxing Energy Use 2019 Using Taxes For Climate Action En Oecd

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg) Countries With The Highest Lowest Corporate Tax Rates

Countries With The Highest Lowest Corporate Tax Rates

Taxing Energy Use 2019 Using Taxes For Climate Action En Oecd

Taxing Energy Use 2019 Using Taxes For Climate Action En Oecd

Oecd Oecd Life Is Good Infographic Data

Oecd Oecd Life Is Good Infographic Data

Corporate Tax Statistics Database Oecd

Corporate Tax Statistics Database Oecd

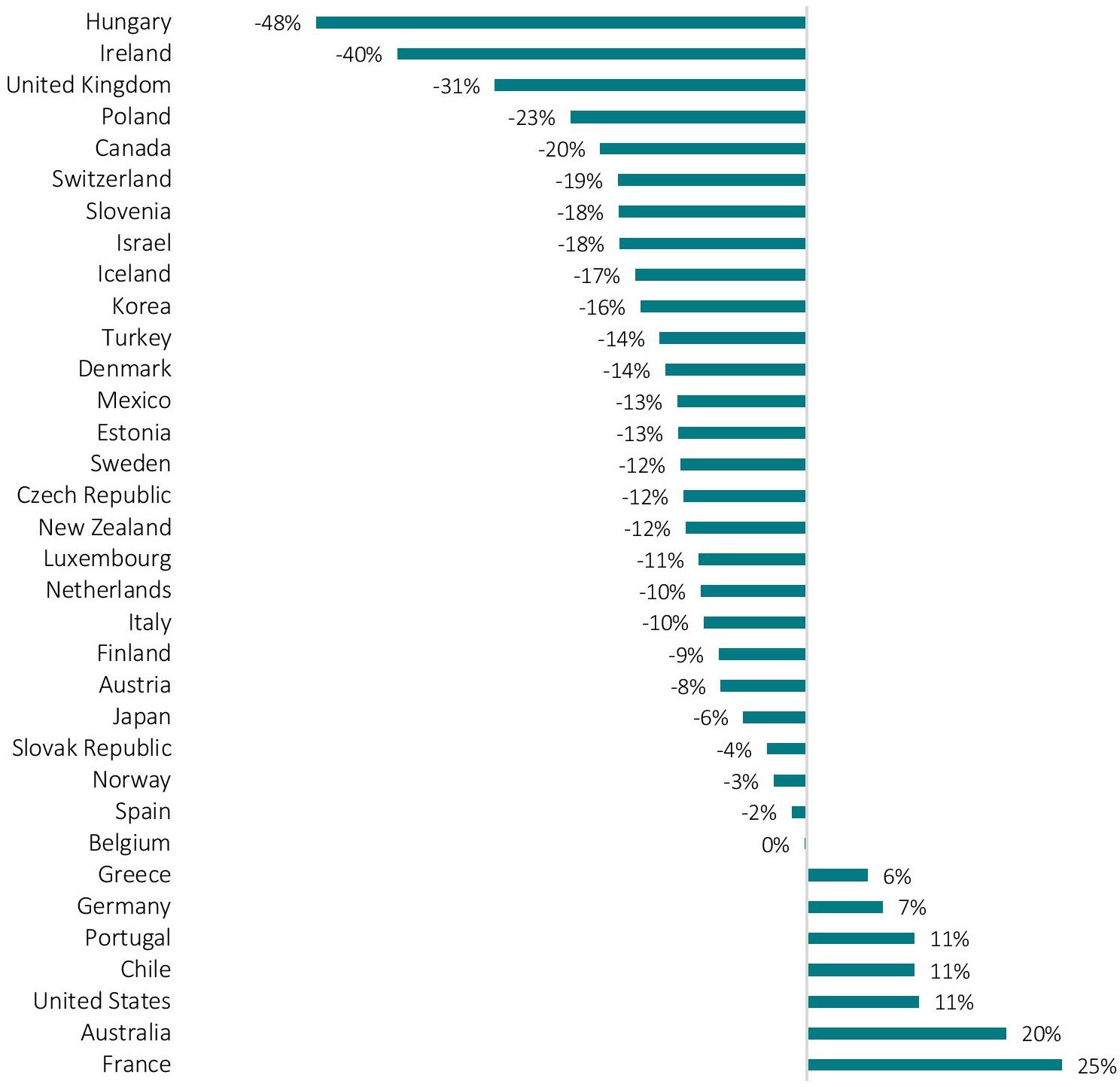

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

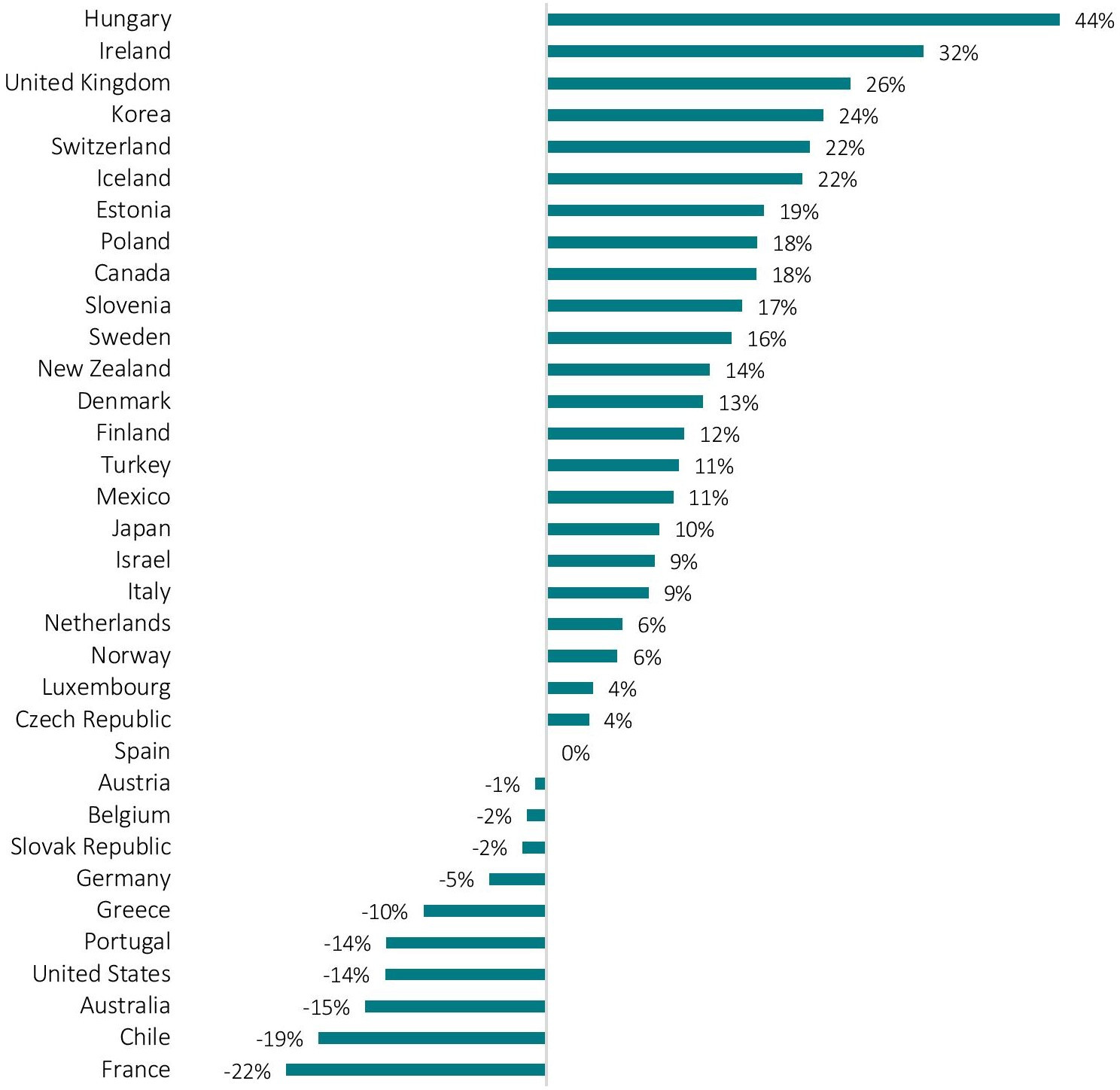

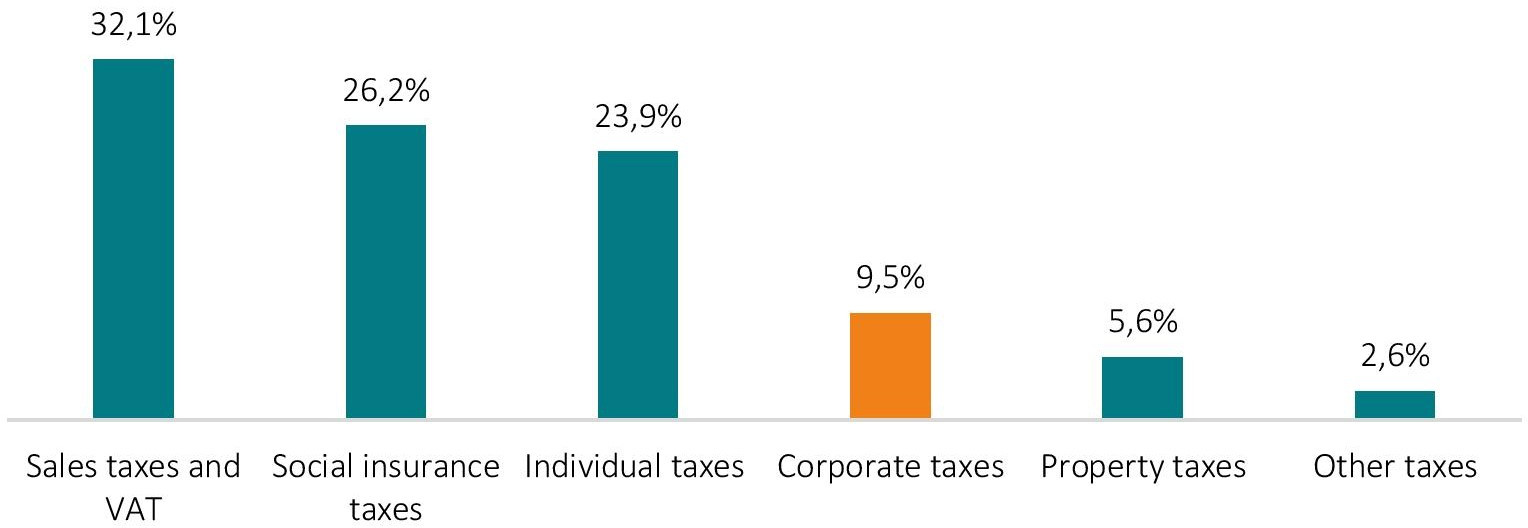

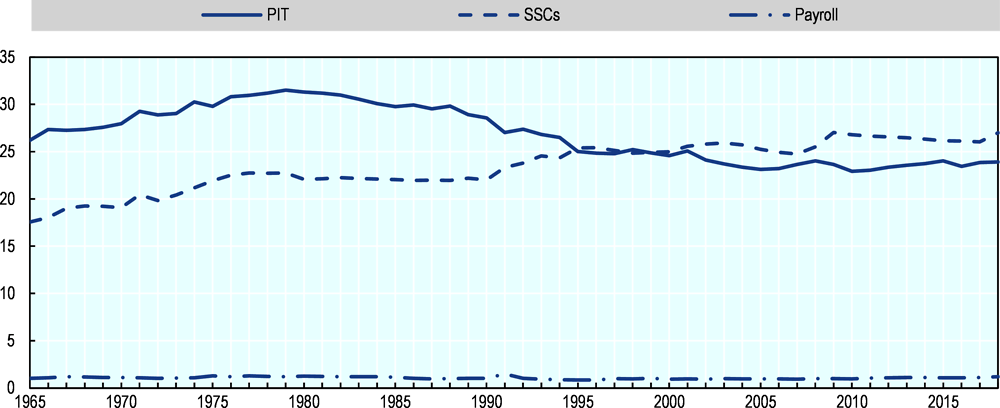

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Post a Comment for "Global Minimum Corporate Tax Oecd"