Disadvantages Of Universal Life Insurance Canada

You can get plans with a Level cost of insurance so you. Unlike universal life insurance for example you cant increase or decrease your coverage if your circumstances change.

Top 10 Pros And Cons Of Variable Universal Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

This alone is often enough to steer people away from this type of coverage.

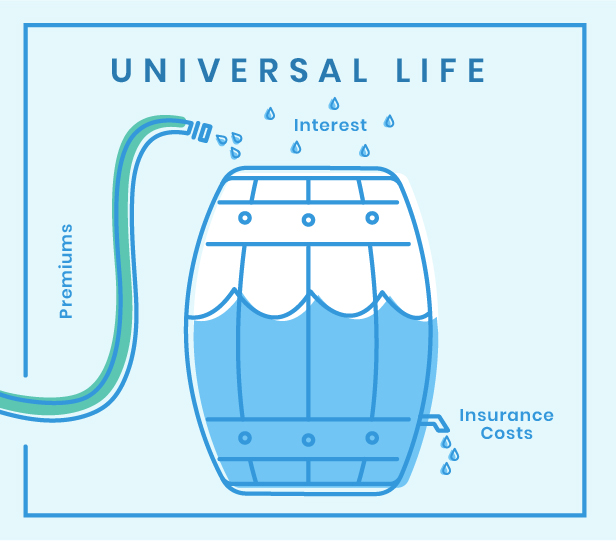

Disadvantages of universal life insurance canada. Universal life insurance policies offer flexibility in when you make your premium payments. If you compare it to the term life insurance it is costly. Flexible premium you can increase or decrease your premiums depending on your budget.

CONS of Universal Life Insurance Level Death Policy. Have to Monitor on Cash. So even if you choose great investments the fees can significantly eat into your returns.

Premium Holidays you can use any cash value within the policy to take a premium holiday if you are short of funds out of work etc. If market rates go down there will be little to no cash value accumulation. Life insurance requires planning ahead.

Universal life insurance does not have a guaranteed cash value unlike whole life insurance where the cash value is guaranteed to only increase with time. But ultimately the death benefit has to be paid. Life insurance moves at the speed of a lifetime.

The cash value of a universal life insurance policy can decrease over time if the policy holder skips too many premium payments resulting in a drawdown of the cash value balance. Your policys cash value depends on the market index. Pay premiums out-of-pocket or use the cash value to pay premiums.

You can pay your premium with your cash value. Universal life policies do not endow. There is the risk that the cash value could drop and cannot cover the cost of the premiums.

Pros and Cons of Universal Life Adjustable Premiums. The premiums are flexible but not necessarily as low as term life insurance. For starters the application process can take several weeks and you may have to take a life insurance exam.

The insured accepts the risks that future investment returns may be inadequate to fund the cost of insurance. But even if you choose a no exam policy you may need to think aheadinto the next decade or beyond. If you buy into a policy and then change your mind later you can cancel.

Pros and Cons of Universal Life Insurance For many policyholders the main selling points of universal life insurance its flexibility and ability to incur more risk are its biggest downsides. It can take a long time to build cash value. Universal Life Insurance Disadvantages.

Universal life UL insurance is permanent life insurance with an investment savings component. You cant adjust your premiums either. With the benefit of having lower premiums in light of the fact that you pay for the unadulterated.

But the downside is you. Disadvantages of UL Policy 1. With a VUL the insurance company has passed the risk to the policy holder in exchange for greater choice and potential gains.

If you foresee income fluctuations you might want to explore a universal life insurance policy. Yes you read that correctly one of the biggest disadvantages of Universal Life Insurance is that the policies can lapse even if you are making payments. Disadvantages of Getting Universal Life Insurance Paying Higher Premiums.

If youre only looking for a policy to cover you for a certain period of time before you have. General Life protection costs much more than different kinds of extra security approaches as far as premiums. If the investment performance does not materialize these policies can lapse.

The management fees and administrative fees for variable universal life insurance policies are typically higher than those for other universal life insurance policies. Pros and cons of universal life insurance. This can create a.

The premiums are usually higher for Universal life insurance compared term life insurance. Pay higher premiums more frequently than required. If you you lose your cash value or you lose a substantial amount of your cash value the policy will be in jeopardy.

With a UL policy as the insured ages the cash value tends to become depleted by the rising cost of insurance inside of the policy. Lest Cash Value Must Be Repaid. Another downside is that when you withdraw or borrow money from a universal life insurance policy it reduces the amount that your beneficiaries would receive if you died before repaying the loan.

To be exact it is three or four times more. With this negative we are not as much referring to Guaranteed Universal contracts as much as IULS and VULs. Pay less premiums less often or even skip payments.

We are not sure why UL policies can even be called permanent when they.

Reviews The Best Life Insurance Companies In Canada 2021 Policyme

Reviews The Best Life Insurance Companies In Canada 2021 Policyme

Infographic Life Insurance Facts In The U S Life Insurance Facts Life Insurance Life Insurance Quotes

Infographic Life Insurance Facts In The U S Life Insurance Facts Life Insurance Life Insurance Quotes

Benefits Of Whole Life Insurance Life Insurance For Seniors Whole Life Insurance Quotes Life Insurance Quotes

Benefits Of Whole Life Insurance Life Insurance For Seniors Whole Life Insurance Quotes Life Insurance Quotes

Life Insurance Company Offers Range Of Tools Life Insurance Premium Calculator To Help Plan For Safe And S Life Insurance Calculator Financial Decisions Life

Life Insurance Company Offers Range Of Tools Life Insurance Premium Calculator To Help Plan For Safe And S Life Insurance Calculator Financial Decisions Life

Tips For Flood Insurance And Your Mortgage Buy Health Insurance Flood Insurance Life Insurance Policy

Tips For Flood Insurance And Your Mortgage Buy Health Insurance Flood Insurance Life Insurance Policy

Life Insurance Buys Vs Needs An Infographic Reality Of Life Life Insurance Premium Life Insurance Policy

Life Insurance Buys Vs Needs An Infographic Reality Of Life Life Insurance Premium Life Insurance Policy

Whole Vs Term Life Insurance What S Better Stashing Coins Whole Life Insurance Term Life Life Insurance Quotes

Whole Vs Term Life Insurance What S Better Stashing Coins Whole Life Insurance Term Life Life Insurance Quotes

Do Single People Need Life Insurance It Depends Affordable Life Insurance Life Insurance For Seniors Life Insurance Beneficiary

Do Single People Need Life Insurance It Depends Affordable Life Insurance Life Insurance For Seniors Life Insurance Beneficiary

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Life Insurance

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Life Insurance

Universal Life Insurance Pros And Cons Termlife2go

Universal Life Insurance Pros And Cons Termlife2go

The Myth Of Americans Poor Life Expectancy Life Insurance Policy Universal Life Insurance Life Insurance Cost

The Myth Of Americans Poor Life Expectancy Life Insurance Policy Universal Life Insurance Life Insurance Cost

Need A Life Insurance Policy Read This Life Insurance Article To Learn About The Importance Of Life In Life Insurance Facts Life Insurance Cost Life Insurance

Need A Life Insurance Policy Read This Life Insurance Article To Learn About The Importance Of Life In Life Insurance Facts Life Insurance Cost Life Insurance

Universal Life Insurance A Policy That Combines Life Insurance With A Cash Account Universal Life Insurance Insurance Sales Life Insurance Sales

Universal Life Insurance A Policy That Combines Life Insurance With A Cash Account Universal Life Insurance Insurance Sales Life Insurance Sales

Disadvantages Of Universal Life Insurance Is It Worth The Premium

Disadvantages Of Universal Life Insurance Is It Worth The Premium

Employer Benefits Marino Financial Group Universal Life Insurance Life Insurance Policy Life Insurance

Employer Benefits Marino Financial Group Universal Life Insurance Life Insurance Policy Life Insurance

Universal Life Insurance Pros And Cons Termlife2go

Universal Life Insurance Pros And Cons Termlife2go

Whole Vs Term Life Insurance Whats Better Life Insurance Facts Life Insurance Policy Life Insurance Agent

Whole Vs Term Life Insurance Whats Better Life Insurance Facts Life Insurance Policy Life Insurance Agent

How Usaa Life Insurance Can Increase Your Profit Usaa Life Insurance Life Insurance Quotes National Life Insurance Universal Life Insurance

How Usaa Life Insurance Can Increase Your Profit Usaa Life Insurance Life Insurance Quotes National Life Insurance Universal Life Insurance

Post a Comment for "Disadvantages Of Universal Life Insurance Canada"