Global Minimum Tax On Us Corporations

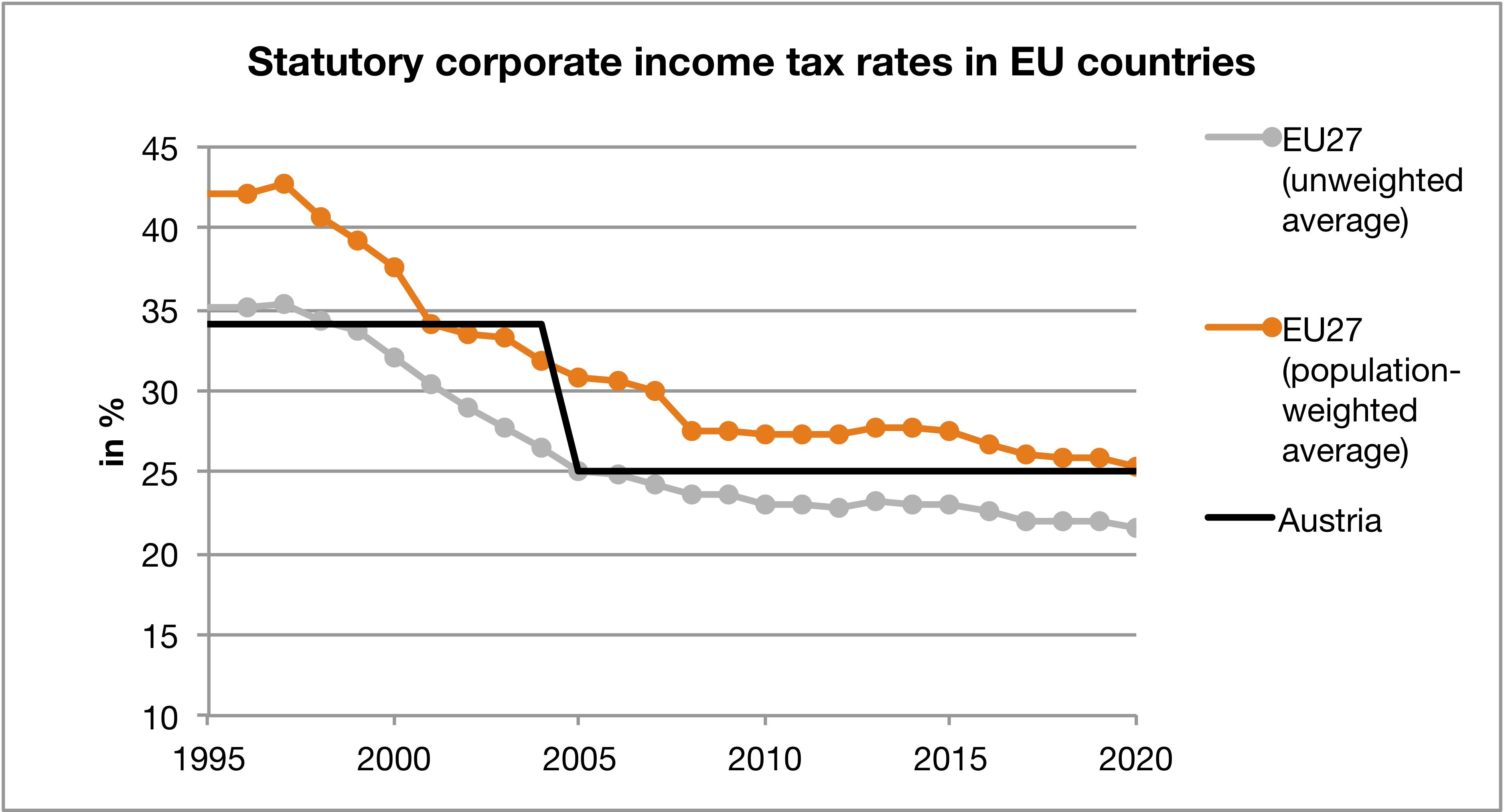

A global minimum rate for corporate tax would decrease tax competition which is detrimental to public economies and causes inequality. Yes this may be a baby step especially since any agreed-upon minimum corporate tax rate would only be voluntary but its a start.

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Democrats have proposed increasing corporate taxes from 21 to 28 to pay for the plan partially reversing the Trump administrations move to cut the corporate tax rate from 35 in 2017.

Global minimum tax on us corporations. The idea is that if there is a unified minimum tax all over the world corporations will no longer be able to shift their profits to countries without taxes. Corporations the effect of the proposed minimum tax would likely be much less. 1 The decrease of corporate tax rates around the world has led to what Yellen has described as a 30-year race to the bottom which has led to tax.

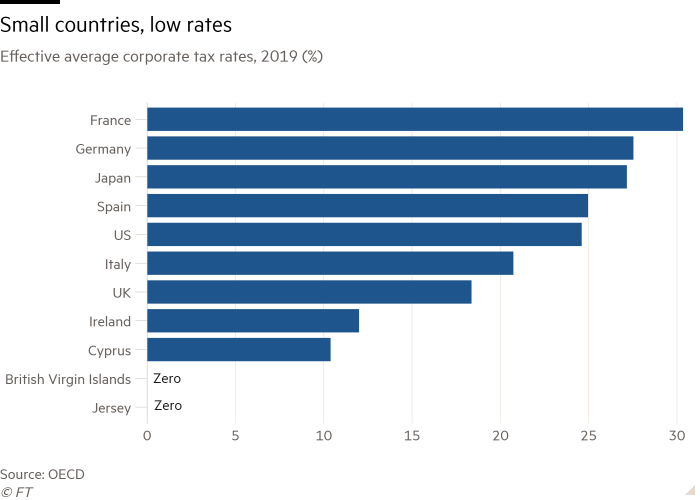

While reducing the US. Companies profits from their global operations in addition to increasing the. A tax rate of 125 percent is under discussion.

A minimum corporate tax rate around 21 would be well above the 125 figure that has been under discussion at the OECD level said Elke Asen a. Because the president-elect has proposed other significant tax increases on US. Multinational corporations can easily avoid corporate.

Proposed by the United States supported by the IMF and welcomed by major economies including France and Germany a global minimum tax rate on corporations is gathering momentum toward becoming a. In 2017 the US cut its corporate tax rate to 21 from 35. Yellens support for a global tax minimum is largely tied to the new US23 trillion infrastructure plan being proposed by President Joe Biden which has faced Republican criticism for its size.

This kind of global treaty between nations based on the model of the Paris Climate Agreement of 2015 could engender a trend toward a more just fair and equitable system of taxation. 23 hours agoGlobal minimum tax of 125 could raise 100 billion. No more tax tricks.

Council of Economic Advisers chair Cecilia Rouse pushed for a global minimum tax on corporations to counteract President Bidens proposed corporate tax. Corporate tax rate to 21 from 35 starting in 2018 the Trump administration implemented a mix of carrots and sticks in a bid. This proposed global minimum tax is ostensibly being pushed to keep this administrations high spending and high taxes from harming American corporations compatibility on.

A minimum global corporate income tax could partially offset any disadvantages that may arise from the US. Treasury Secretary Janet Yellen has called for a minimum corporate income tax that would be shared by countries all over the world. In a speech to the Chicago Council on Global Affairs US.

The new tax would apply a minimum 15. Neuezeitat - May 14 2021. The message reinforced President Joe Bidens recent call for raising the minimum tax already in place on US.

No official global minimum tax rate on corporations has been decided but estimates range between 125 percent and 21 percent. A global minimum tax for companies aims to put a stop to this tax trick. The global minimum push is coming alongside the Bidens administration to raise taxes at home.

European Union should support OECD United States and others in adopting the minimum level. President Joe Bidens infrastructure proposal called the American Jobs Plan would increase the minimum tax on US corporations to 21 and. Global minimum tax for corporations could raise 100 billion.

US Treasury Secretary Janet Yellen followed up last week with calls for a global minimum corporate tax of 21 per cent for multinational corporations signaling that a collective international. Corporate tax hike and would help pay for the White Houses ambitious 23T.

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg) Countries With The Highest Lowest Corporate Tax Rates

Countries With The Highest Lowest Corporate Tax Rates

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Sources Of Government Revenue In The United States Tax Foundation

Sources Of Government Revenue In The United States Tax Foundation

The Push For A Global Minimum Corporate Tax Rate News Article

The Push For A Global Minimum Corporate Tax Rate News Article

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

The Case For Preserving A Competitive Corporate Tax Rate U S Chamber Of Commerce

The Case For Preserving A Competitive Corporate Tax Rate U S Chamber Of Commerce

The Shareholder Revolution Devours Its Children Corporate Profits Revolution Economy

The Shareholder Revolution Devours Its Children Corporate Profits Revolution Economy

Top Twelve American Banks Coal And Oil Companies Paid Less Taxes Than You Infographic Federal Income Tax Oil Company

Top Twelve American Banks Coal And Oil Companies Paid Less Taxes Than You Infographic Federal Income Tax Oil Company

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Europe S Low Tax Nations Braced For Struggle Over Us Corporate Tax Plan Financial Times

Europe S Low Tax Nations Braced For Struggle Over Us Corporate Tax Plan Financial Times

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg) Countries With The Highest Lowest Corporate Tax Rates

Countries With The Highest Lowest Corporate Tax Rates

How Fortune 500 Companies Avoid Paying Income Tax

Post a Comment for "Global Minimum Tax On Us Corporations"