Global Minimum Tax Pillar 2

105 effective statutory rate 21 standard rate with a 50 earnings deduction. Under pillar 2 of the work plan a new GloBE proposal would enact a global minimum tax similar to the US.

Taxation Of The Digital Economy Bdo

Taxation Of The Digital Economy Bdo

Pillar Two is about achieving a global minimum level company tax harmonisation.

Global minimum tax pillar 2. Pillar Two blueprint on a global minimum tax issued in On 12 October 2020 the G20OECD Inclusive Framework on BEPS inclusive framework released two detailed blueprints in relation to its ongoing work to address the tax challenges arising from the digitalization of the economy. Pillar Two is the second prong of the OECDs Inclusive Framework plan to realign the international tax framework to adequately address the challenges of an increasingly digitalised economy and the first thing you should know is that it has nothing to do with digitalisation. Global Minimum Taxation Pillar Two applies where even after the effect of Pillar One if any.

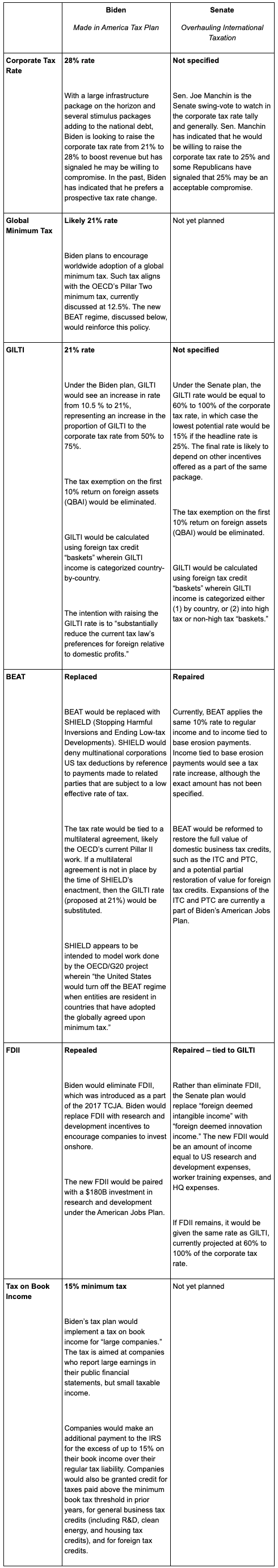

At the heart of the project lies the yet to be determined minimum level of taxation the global minimum rate. Pillar Two effectively seeks to enforce a global yet to be determined minimum level of effective taxation on income derived by large multinational enterprises MNEs. The Biden administration could avoid this by aligning its reform of the GILTI regime with the OECDs Base Erosion and Profit Shifting BEPS Pillar 2 proposal for worldwide minimum corporate income taxation.

That same year a programme of work to be conducted on Pillar One and Pillar Two was adopted and later endorsed by the G20. KPMG report Pillar Two KPMG report taxation of the digitalized economy KPMG in the UK digitalized economy portal page KPMG BEPS 20 Model. Our modelling of the OECD pillar 2 proposal in order to compare with our METR Minimum Effective Tax Rate proposal suggests that even the OECD approach with a Biden-backed minimum rate of 21 would yield some 300bn or more in additional revenues worldwide.

This Pillar seeks to comprehensively address remaining BEPS challenges by ensuring that the profits of internationally operating businesses are subject to a minimum rate of tax. There has been quite a lot of media coverage recently on domestic and corporate tax proposals by the new Biden Administration in the United States with reports of a much higher global minimum tax rate being proposed to the OECD Inclusive Framework by the US as part of the ongoing work on Pillar Two of BEPS 20. The Global Anti-Base Erosion proposal Pillar Two of the Workplan seeks to develop an integrated set of global minimum tax rules to ensure that the profits of internationally operating businesses are subject to at least a minimum rate of tax.

Base-erosionand anti-abusetax BEAT provisions. For months the OECD has mentioned in its pillar 2 consultations and calculations a 125 minimum corporate tax rate but it seems the final rate for a global anti-base-erosion tax. After the effect of Pillar One if any multinationals are regarded as undertaxed by reference to an agreed minimum level of taxation.

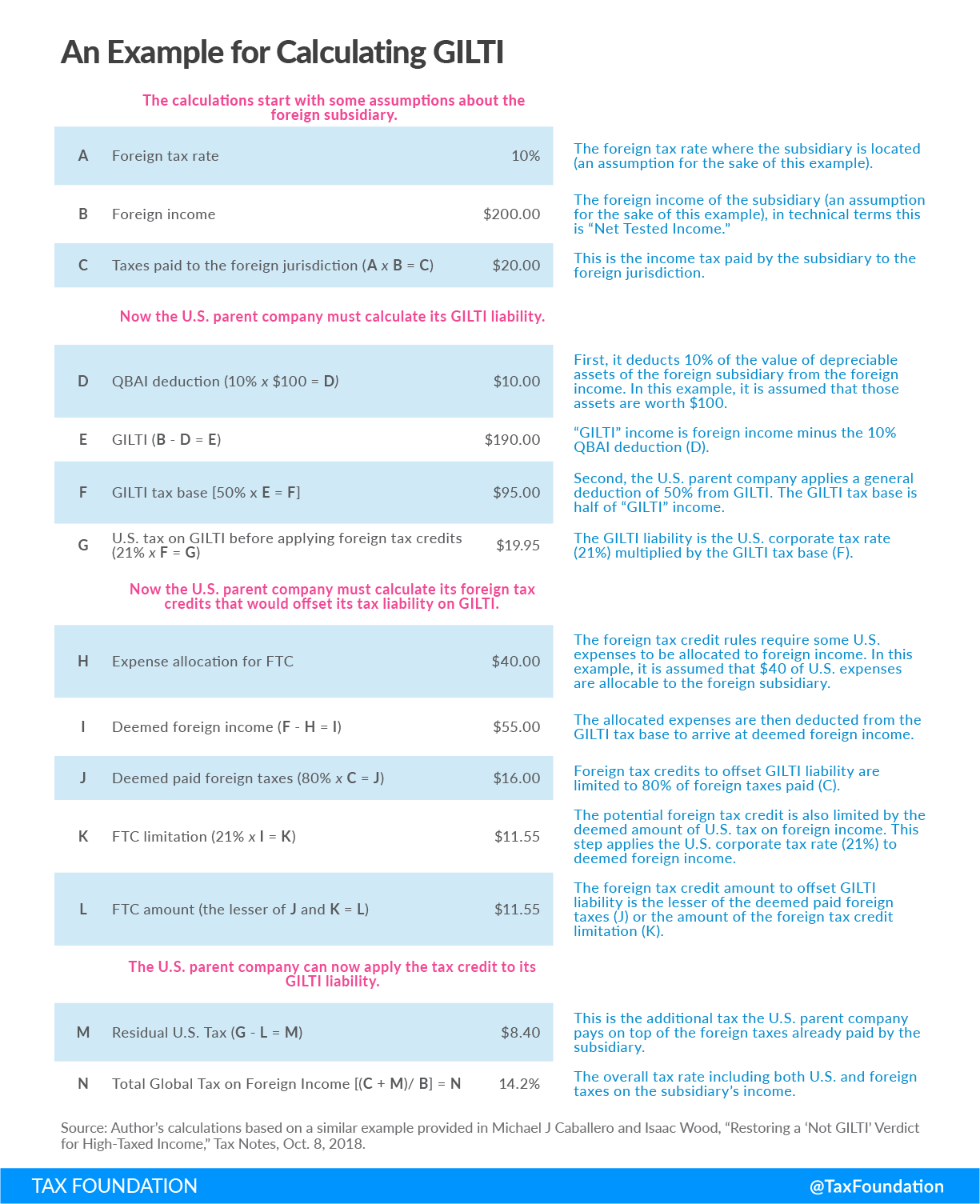

This report explores options and issues in connection with the design of a global minimum tax that would address remaining BEPS issues. Leveling the playing field Pillar Two has. Global intangible low-taxedincome GILTI provisions from a policy perspective and a tax on base-erosionpayments similar to the US.

This minimum level constitutes the benchmark against which the effective company tax payable in a country effective tax rate ETR is assessed. Like Pillar One the GloBE proposal under Pillar Two represents a substantial change to the international tax architecture. G20OECD Inclusive Framework issues Pillar Two Blueprint on a global minimum tax On 12 October 2020 the G20OECD Inclusive Framework on Base Erosion and Profit Shifting Inclusive Framework released two detailed Blueprints in relation to its ongoing work to address the tax challenges arising from the digitalisation of the economy.

Download PDF 116 kB. The current GILTI tax has the following main features. To that end it combines domestic and treaty-based measures that allow the other jurisdictions where the MNE operates notably the jurisdiction of the ultimate parent entity to charge a top-up amount of tax on resident.

Further reading resources.

All You Need To Know About Global Minimum Corporate Tax Ipleaders

All You Need To Know About Global Minimum Corporate Tax Ipleaders

G20 Oecd Inclusive Framework Issues Pillar Two Blueprint On A Global Minimum Tax

G20 Oecd Inclusive Framework Issues Pillar Two Blueprint On A Global Minimum Tax

Delays Ahead An Update On The Oecd S Global Corporate Tax Reform

Delays Ahead An Update On The Oecd S Global Corporate Tax Reform

Global Intangible Low Tax Income Gilti Tax Basics Tax Foundation

Global Intangible Low Tax Income Gilti Tax Basics Tax Foundation

Itr Live Oecd Consultation On Pillar Two International Tax Review

Itr Live Oecd Consultation On Pillar Two International Tax Review

Oecd Consultation Document On Global Minimum Taxation Proposal Pillar Two Deloitte Australia Tax Insights

Oecd Consultation Document On Global Minimum Taxation Proposal Pillar Two Deloitte Australia Tax Insights

Pillar Two Blueprint On A Global Minimum Tax Issued Tax And Legal Blog

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Transfer Pricing 2021 Global Practice Guides Chambers And Partners

Transfer Pricing 2021 Global Practice Guides Chambers And Partners

Who In The World Is Joe Manchin International Tax Proposals Vary Under Biden Senate Proposals Lexology

Who In The World Is Joe Manchin International Tax Proposals Vary Under Biden Senate Proposals Lexology

Https Www2 Deloitte Com Content Dam Deloitte Au Documents Tax Deloitte Au Tax Insights 31 Pillar Two Blueprint 151020 Pdf

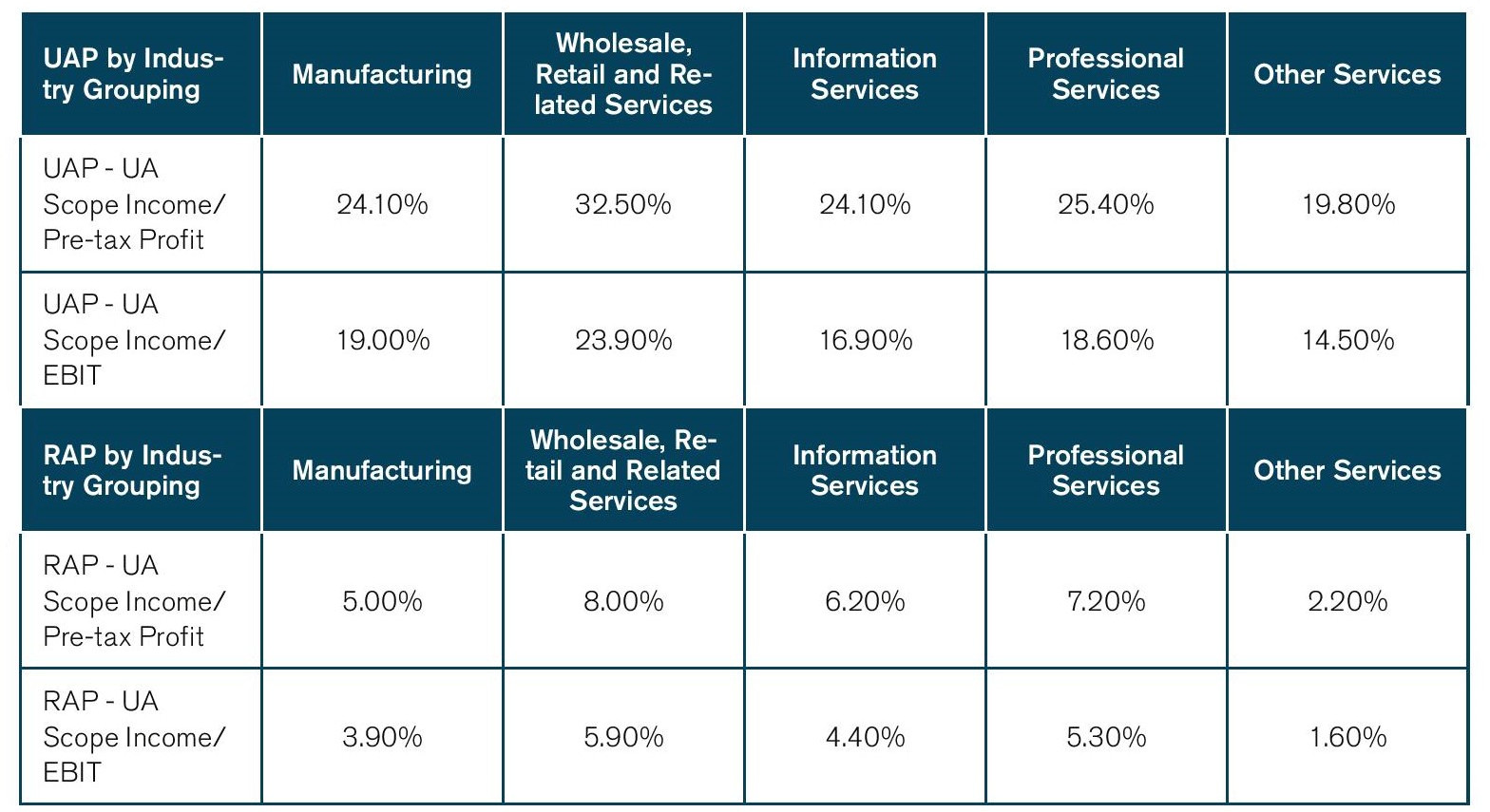

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Amid Political Rancor Global Digital Tax Deal Pushed Back Until Mid 2021 Politico

Amid Political Rancor Global Digital Tax Deal Pushed Back Until Mid 2021 Politico

Us Offers New Plan In Global Corporate Tax Talks

Us Offers New Plan In Global Corporate Tax Talks

Are We On The Verge Of A Global Digital Taxation Treaty Brink News And Insights On Global Risk

Are We On The Verge Of A Global Digital Taxation Treaty Brink News And Insights On Global Risk

Bover Architectural Lighting Design Column Design Interior Wall Design

Bover Architectural Lighting Design Column Design Interior Wall Design

Post a Comment for "Global Minimum Tax Pillar 2"