Global Minimum Tax On Corporations

A global minimum tax for companies aims to put a stop to this tax trick. Treasury Secretary Janet Yellen is one of them.

Doing Business In The United States Federal Tax Issues Pwc

Doing Business In The United States Federal Tax Issues Pwc

Yellen to push for global minimum tax on corporations Published Mon Apr 5 2021 826 AM EDT Updated Mon Apr 5 2021 1121 AM EDT Jeff Cox jeffcox7528 JeffCoxCNBCcom.

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)

Global minimum tax on corporations. This proposed global minimum tax is ostensibly being pushed to keep this administrations high spending and high taxes from harming American corporations compatibility on. The organizations calculations rely on most countries adopting a 125 minimum rate and the United States retaining its current global minimum tax regime which includes a. More content below.

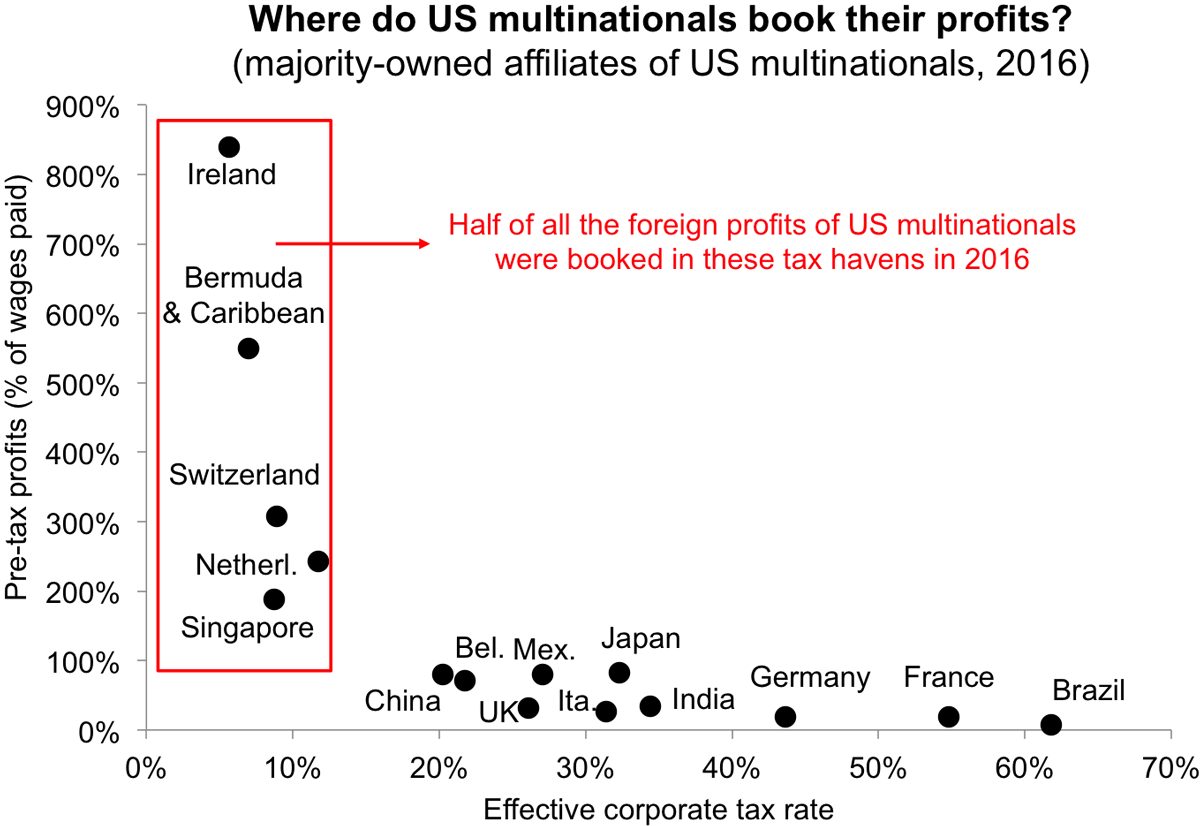

The idea is that if there is a unified minimum tax all over the world corporations will no longer be able to shift their profits to countries without taxes. 23 hours agoGlobal minimum tax of 125 could raise 100 billion. Corporate tax rate to 28 so it has proposed a global minimum of 21 double the rate on the current GILTI tax.

A global minimum corporate tax would set the same minimum tax rate for companies globally regardless of their operational locations. Recently Treasury Secretary Janet Yellen unveiled a new proposal to implement a global minimum tax on corporations to prevent these vast businesses from shopping around for the lowest rate. The proposal will not only embarrass US.

Secretary of Treasury Janet Yellen has garnered this weeks tax spotlight with her support and request for the world to support a minimum global corporate income tax. Yellen is specifically advocating for the adoption of a global minimum levy for corporations in order to avoid a race to the bottom on taxation. Companies profits from their global operations in addition to increasing the.

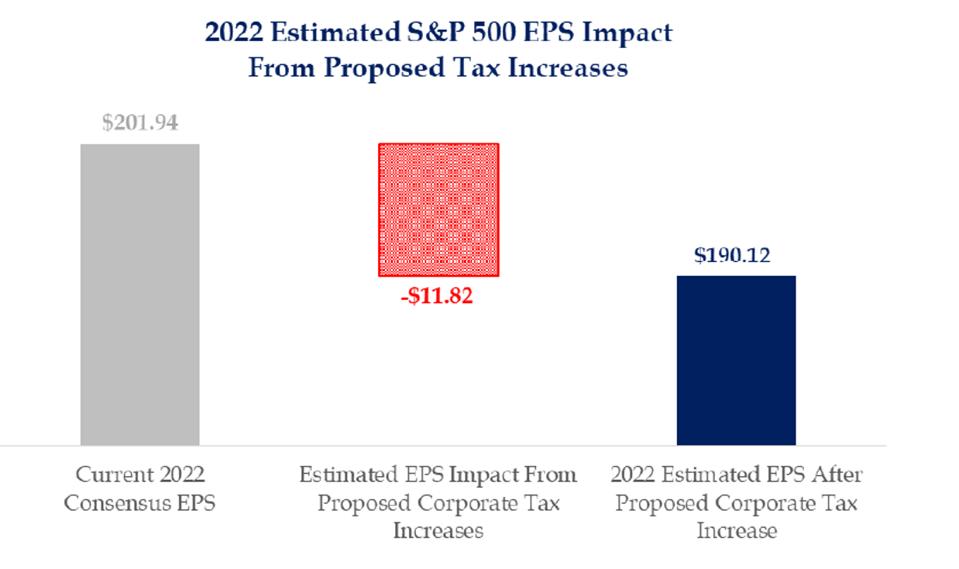

Multinational corporations from 105 to 21 which would be calculated on a. President Joe Bidens infrastructure proposal called the American Jobs Plan would increase the minimum tax on US corporations to 21 and. The Biden administration wants to raise the US.

As part of his plan the president is also calling for upping the minimum tax on US. Corporate tax rate to 28 so it has proposed a global minimum of 21 - double the rate on the. The message reinforced President Joe Bidens recent call for raising the minimum tax already in place on US.

In 2017 the US cut its corporate tax rate to 21 from 35 but Biden proposed raising it. 13 hours ago4D Chess. With a global minimum rate of 15 in effect Country A would top up the tax and collect another 4 of the companys profit from Country B -- representing the difference between Country Bs.

The new US. Council of Economic Advisers chair Cecilia Rouse pushed for a global minimum tax on corporations to counteract President Bidens proposed corporate tax. A tax rate of 125 percent is under discussion.

This would be in addition to raising the corporate tax. It also wants the minimum to apply to US. The global minimum push is coming alongside the Bidens administration to raise taxes at home.

Proposed by the United States supported by the IMF and welcomed by major economies including France and Germany a global minimum tax rate on corporations is gathering momentum toward becoming a. Companies no matter where the taxable income is earned. Proposed by the United States supported by the IMF and welcomed by major economies including France and Germany a global minimum tax rate on corporations is.

The tax rate alongside the proposal to tax businesses solely based on their locations of profit are the two core pillars of the Base Erosion and Profit Shifting BEPS initiative1. The global minimum corporate tax outlined by US. This would apply to the largest and most profitable businesses numbering around 100 with the suggestion that the minimum rate to be applied to be 21 and be.

President Biden has proposed hiking the. The Biden administration wants to raise the US.

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg) Countries With The Highest Lowest Corporate Tax Rates

Countries With The Highest Lowest Corporate Tax Rates

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg) Countries With The Highest Lowest Corporate Tax Rates

Countries With The Highest Lowest Corporate Tax Rates

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Why We Need A Minimum Tax On U S Corporations Foreign Profits Center For American Progress

The Shareholder Revolution Devours Its Children Corporate Profits Revolution Economy

The Shareholder Revolution Devours Its Children Corporate Profits Revolution Economy

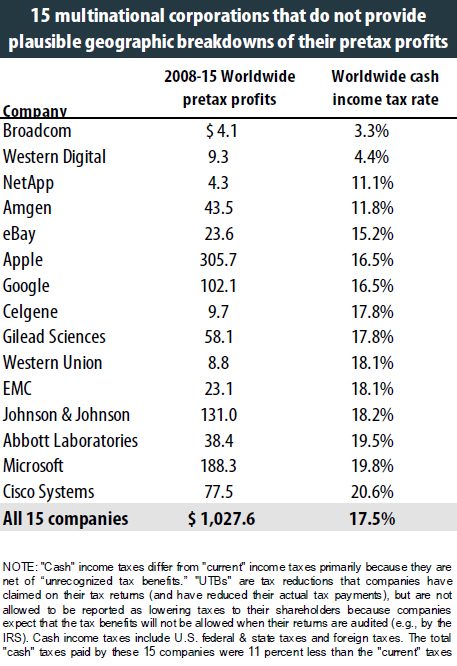

The 35 Percent Corporate Tax Myth Itep

The 35 Percent Corporate Tax Myth Itep

Taxing Multinational Corporations In The 21st Century Economics For Inclusive Prosperity

Taxing Multinational Corporations In The 21st Century Economics For Inclusive Prosperity

Difference Between Accounting Depreciation And Tax Depreciation Accounting Depreciation Vs Tax Depreciation Accounting Tax Different

Difference Between Accounting Depreciation And Tax Depreciation Accounting Depreciation Vs Tax Depreciation Accounting Tax Different

New Proposed Corporate Tax Rate Could Negatively Impact Most Investors

New Proposed Corporate Tax Rate Could Negatively Impact Most Investors

Declining Worker Power And American Economic Performance Worker Economic Efficiency Corporate Profits

Declining Worker Power And American Economic Performance Worker Economic Efficiency Corporate Profits

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Why We Need A Minimum Tax On U S Corporations Foreign Profits Center For American Progress

The Tcja 2 Years Later Corporations Not Workers Are The Big Winners Center For American Progress

The Tcja 2 Years Later Corporations Not Workers Are The Big Winners Center For American Progress

How Fortune 500 Companies Avoid Paying Income Tax

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

International Estate And Income Tax Planning Strategies Accounting Jobs Finance Jobs Retirement Savings Plan

International Estate And Income Tax Planning Strategies Accounting Jobs Finance Jobs Retirement Savings Plan

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Post a Comment for "Global Minimum Tax On Corporations"