Kkr Acquires Global Medical Response

Agreed to buy the retirement and life-insurance company Global Atlantic Financial Group Ltd. The subscription promises that the patient will not be billed out-of-network for any flight in the AirMedCare Network.

Former Kkr Vet Jim Momtazee Launches Healthcare Investment Firm Patient Square Capital

Former Kkr Vet Jim Momtazee Launches Healthcare Investment Firm Patient Square Capital

KKR-backed Air Medical Group Holdings is acquiring Envision Healthcare Corps medical transportation unit American Medical Response in a 24 billion transaction.

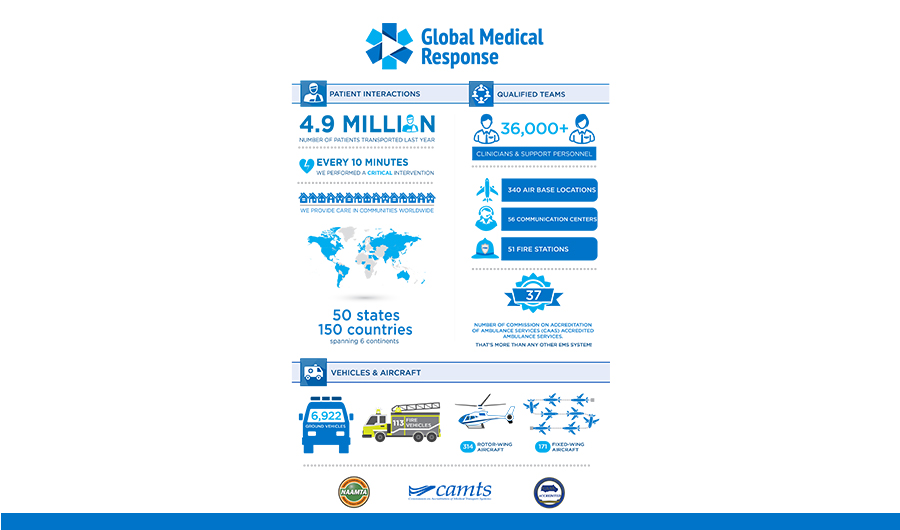

Kkr acquires global medical response. One Med Evac CO owned by AirMedCare Network an affiliation of four seemingly independent companies all of which are owned by Global Medical Response a portfolio company of KKR offers a 10-year subscription for 575 and a 25-year membership for 1125. Agreed to a deal that will add more heft to an ambulance business it owns as the private-equity firm continues to bulk up its health-care holdings. LEWISVILLE Texas-- BUSINESS WIRE--Envision Healthcare Corporation Envision NYSE.

EVHC and an entity controlled by funds affiliated with KKR have entered into a definitive agreement under which KKRs portfolio company Air Medical Group Holdings AMGH and Envisions medical transportation subsidiary American Medical Response AMR will combine to. EVHC and an entity controlled by funds affiliated with KKR. Simpson Thacher Bartlett LLP and Willkie Farr Gallagher LLP advised KKR while Debevoise Plimpton LLP acted as legal advisor to Global Atlantic.

Momtazee spent 21 years at KKR where he helped form the healthcare industry group in. KKR also owns Global Medical Response a provider of medical transportation services that was created when the firm purchased American Medical Response and. AMGH an entity controlled by funds affiliated with multinational private equity firm KKR and American Medical Response AMR a subsidiary of Envision Healthcare Corporation have entered into a definitive agreement under which KKR will buy AMR from Envision.

KKRs Acquisition of Global Atlantic Financial Group. Reuters - Envision Healthcare Corp EVHCN said on Tuesday it would sell its ambulance business to buyout firm KKR Co KKRN in an all-cash deal valued at 24 billion as it sharpens its focus on. KKR and Global Atlantic Financial Group Limited Global Atlantic signed a strategic transaction where KKR.

In March 2018 American Medical Response became a subsidiary of Global Medical Response. The history of private equity and venture capital and the development of these asset classes has occurred through a series of boom-and-bust cycles since the middle of the 20th century. KKR Co.

KKR acquired Air Medical in 2015 for around US2bn Reuters has reported. LEWISVILLE Texas and NEW YORK-- BUSINESS WIRE--Air Medical Group Holdings Air Medical a leading provider of air ambulance services. Announced that American Medical Response would be sold to KKR Co.

And LEWISVILLE Texas - August 8 2017 - Envision Healthcare Corporation Envision NYSE. KKR Co. On September 8 2017 Envision Healthcare Corp.

Within the broader private equity industry two distinct sub-industries leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks. Ex-KKR healthcare chief Jim Momtazee launches Patient Square Capital. For more than 44 billion in a deal that would boost the private-equity firms assets.

The deal is valued at. KKR is a leading global investment firm that offers alternative asset management and capital markets and insurance solutions. KKR aims to generate attractive investment returns by following a patient and disciplined investment approach employing world-class people and supporting growth in its portfolio companies and communities.

Air Medical Group Holdings a KKR portfolio company is buying American Medical Response from Envision Healthcare Corp. The deal was backed by a US101bn term loan and a US370 unsecured bond. Envision Healthcare Corporation and an entity controlled by funds affiliated with KKR have entered into a definitive agreement under which KKRs portfolio company Air.

Combining to create a new industry leading medical transportation company Air Medical Group Holdings Inc. LP in an all-cash deal worth US24 billion. KKR Grants is a global effort focused on identifying and supporting the most innovative and effective nonprofits whose missions are aligned with priority areas including delivering immediate aid.

KKR buys AMR for 24bn.

Kkr Completes Acquisition Of Ramky Enviro Engineers Business Wire

Kkr Completes Acquisition Of Ramky Enviro Engineers Business Wire

Amgh Buying Air Ambulance Provider Sevenbar General Aviation News Aviation International News

Amgh Buying Air Ambulance Provider Sevenbar General Aviation News Aviation International News

Kkr Buys Amr For 2 4bn Financier Worldwide

Kkr Buys Amr For 2 4bn Financier Worldwide

Envision Healthcare To Sell American Medical Response Airmedcare Network

Envision Healthcare To Sell American Medical Response Airmedcare Network

News Airmed International Air Ambulance Services

American Medical Response Temecula Chamber Of Commerce

American Medical Response Temecula Chamber Of Commerce

American Medical Response Temecula Chamber Of Commerce

American Medical Response Temecula Chamber Of Commerce

Envision Healthcare To Sell American Medical Response Business Wire

Envision Healthcare To Sell American Medical Response Business Wire

What We Learned From The Challenges Of 2020

What We Learned From The Challenges Of 2020

Kkr To Acquire Air Medical Group Holdings Business Wire

Kkr To Acquire Air Medical Group Holdings Business Wire

Patient Square Capital Formed To Become The Premier Dedicated Health Care Investment Firm

Patient Square Capital Formed To Become The Premier Dedicated Health Care Investment Firm

Us Private Equity Firm Kkr To Acquire 2 32 Stake In Jio Platforms For Rs 11 367 Crore

Amgh Amr Combine To Form Global Medical Response Airmedcare Network

Amgh Amr Combine To Form Global Medical Response Airmedcare Network

Investment Firm Kohlberg Kravis Roberts Closes 2 4 Billion Deal With Envision Healthcare Acquires Covenant Surgical Partners Healthcare Finance News

Investment Firm Kohlberg Kravis Roberts Closes 2 4 Billion Deal With Envision Healthcare Acquires Covenant Surgical Partners Healthcare Finance News

Blackstone Kkr Draw Ire From Congress Over Surprise Medical Bills Pitchbook

Blackstone Kkr Draw Ire From Congress Over Surprise Medical Bills Pitchbook

Amgh And Amr Complete Transaction And Combine Under New Parent Company Global Medical Response

Amgh And Amr Complete Transaction And Combine Under New Parent Company Global Medical Response

Kkr Continues Mega Deals With 9 9b Envision Agreement Pitchbook

Kkr Continues Mega Deals With 9 9b Envision Agreement Pitchbook

Post a Comment for "Kkr Acquires Global Medical Response"