Global X Etf Europe

1 Freedom Valley Drive Oaks PA 19456 is the distributor for the Global X Funds. SEI Investments Distribution Co.

Global X Renewable Energy Producers Etf Rnrg

Global X Renewable Energy Producers Etf Rnrg

1 December 2020 ETF issuer Global X has hired a team of senior executives in London to help manage the launch of its European ETF business.

Global x etf europe. The funds are distributed by SEI Investments Distribution Co. In the last trailing year the best-performing Global X ETF was COPX at 21135. New York-based Global X is.

Luis Berruga Global X. The firm listed the Global X Video Games Esports UCITS ETF HERU and the Global X Telemedicine Digital Health UCITS ETF EDOC on the London Stock Exchange in mid-December according to a statement from the firm. International Access ETFs offer sector exposure to China and solutions targeting other markets in Asia Europe Latin America and beyond.

The firm which announced its formal entrance to European markets on December 1 is launching the Global X Video Games Esports UCITS ETF HERU and. Check the background of SIDCO and Global Xs Registered Representatives on FINRAs. Thematic ETFs in Europe Flourishing.

The survey which interviewed 60 global ETF players including issuers market makers and administrators found 85 of European respondents have predicted ETFs to pass 25trn by 2025 a 21 compound. The largest Global X ETF is the Global X US. The Global X MSCI SuperDividend EAFE ETF EFAS invests in 50 of the highest dividend yielding equity securities from the MSCI EAFE Index which includes securities from international developed markets across Europe Australasia and the Far East.

Global X ETFs has launched its first two offerings in Europe today following the New York-based ETF providers European business launch earlier this month. The video game funds mark Global Xs first launches in Europe. SIDCO 1 Freedom Valley Drive Oaks PA 19456 which is not affiliated with Global X Management Company LLC or Mirae Asset Global.

Global X ETFs the New York-based provider of exchange-traded funds ETFs announced on Monday the launch of its European business operation. Infrastructure Development ETF PAVE with 340B in assets. The European ETF market is set to hit at least 25trn assets under management AUM by 2025 according to a survey conducted by PwC a growth rate quicker than even in the US.

Global X ETFs Enters European Market. Global X Video Games Esports UCITS ETF HERU and Global X Telemedicine Digital Health UCITS ETF EDOC are. Market for thematic exchange-traded funds is firing the first shots in its bid to conquer Europe.

Global X Management Company LLC serves as an advisor to the Global X Funds. ETF markets in Europe can look forward to welcoming a new participant in the coming weeks as New York-based Global X ETFs has announced its intention to cross the Atlantic and add to the geographic foot parent of its Korean parent Mirae Asset Global Investments who distribute ETFs across Asia the Americas. One team one shared mission.

Global X ETFs is a member of Mirae Asset Financial Group a Seoul-based global enterprise which offers asset management expertise worldwide. Global X has entered the European ETF market with the launch of two thematic strategies focusing on video gaming and digital health. Global X known for its thematic growth income and.

The Global X Video Games Esports UCITS ETF HERU and the Global X Telemedicine Digital Health UCITS ETF EDOC are listed on the London Stock Exchange LSE with total expense ratios TERs of 050 and 068 respectively. Oliver will be responsible for leading the firms UCITS ETF distribution efforts across the continent. Global X ETFs adds three to European business 11012021 - 450pm Global X ETFs has added three new hires to its European business including the key appointment of George Taylor who joins as Head of Capital Markets for Global X ETFs with responsibility for primary and secondary market structure as well as investor implementation in ETFs.

Global X ETFs has launched in Europe as the New York-based exchange-traded funds provider aims to add to the global footprint of its parent Seoul-based Mirae Asset Global Investments which distributes ETFs in the Americas and Asia. Mirae Assets Global X the New York based provider of ETFs is to launch in Europe with the hire of Rob Oliver from JP Morgan as Head of Business Development for Global X ETFs in Europe and Morgane Delledonne pictured from BMO Global Asset Management as Director of Research. The ETF issuer known for its thematic income and international access strategies is planning to roll out several UCITS ETFs in the coming months.

One of the major players in the US. The move follows after Global X announced on 1 December that it was launching its European business operation. Luis Berruga chief executive of Global X told Markets Media that the European ETF.

United States Natural Gas Fund Gas Stock Charts Dow Chemical

United States Natural Gas Fund Gas Stock Charts Dow Chemical

Uranium Etf Ready To Break A Long Slumber Stock Charts Canadian Dollar Supportive

Uranium Etf Ready To Break A Long Slumber Stock Charts Canadian Dollar Supportive

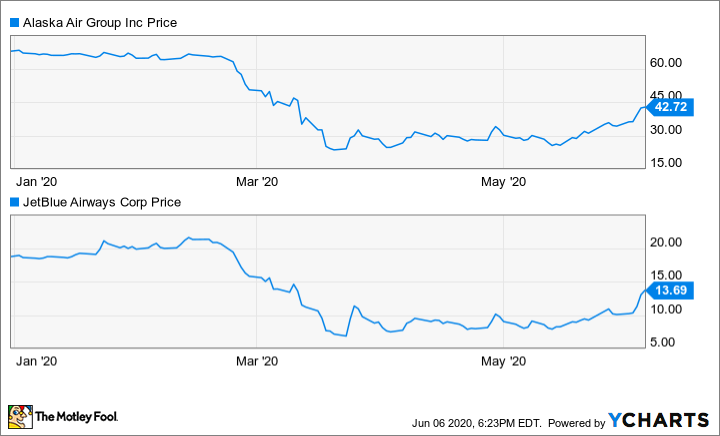

This Hot Airline Etf Surged 67 In 3 Weeks Why You Should Stay Away The Motley Fool

This Hot Airline Etf Surged 67 In 3 Weeks Why You Should Stay Away The Motley Fool

Can Etfs Go Bankrupt Here S What Happens When Etfs Fail Marvin Allen

Can Etfs Go Bankrupt Here S What Happens When Etfs Fail Marvin Allen

A Global Passive Benchmark With Etfs And Factor Tilts Resolve Asset Management

A Global Passive Benchmark With Etfs And Factor Tilts Resolve Asset Management

Copx Accumulate The Global X Copper Miners Etf As The Green Energy And Ev Booms Begin Nysearca Copx Seeking Alpha

Copx Accumulate The Global X Copper Miners Etf As The Green Energy And Ev Booms Begin Nysearca Copx Seeking Alpha

A Global Passive Benchmark With Etfs And Factor Tilts Resolve Asset Management

A Global Passive Benchmark With Etfs And Factor Tilts Resolve Asset Management

Scientific Beta Factor Report Q1 2020 Global X Etfs

Scientific Beta Factor Report Q1 2020 Global X Etfs

![]() Explain It To A Golden Retriever A Lifetime Investment World Etfs Comparison Bankeronwheels Com

Explain It To A Golden Retriever A Lifetime Investment World Etfs Comparison Bankeronwheels Com

Ishares Tips Bond Etf Nysearca Tip Ishares Protect Security Stock Charts

Ishares Tips Bond Etf Nysearca Tip Ishares Protect Security Stock Charts

Explain It To A Golden Retriever A Lifetime Investment World Etfs Comparison Bankeronwheels Com

Explain It To A Golden Retriever A Lifetime Investment World Etfs Comparison Bankeronwheels Com

Global X Etfs Launches First Two Ucits Etfs In Europe

Global X Fintech Etf Or Ark Fintech Innovation Etf Nanalyze

Global X Fintech Etf Or Ark Fintech Innovation Etf Nanalyze

S P Catholic Values Developed Ex U S Etf

S P Catholic Values Developed Ex U S Etf

A Global Passive Benchmark With Etfs And Factor Tilts Resolve Asset Management

A Global Passive Benchmark With Etfs And Factor Tilts Resolve Asset Management

Best International Etf Our Top 10 To Consider In 2021

Best International Etf Our Top 10 To Consider In 2021

Global X Social Media Index Etf Social Media Social Rsi

Global X Social Media Index Etf Social Media Social Rsi

Post a Comment for "Global X Etf Europe"