Global Minimum Business Tax

13 hours ago4D Chess. The global minimum tax rate undeniably increases businesses operating costs.

How Would A Global Minimum Tax Work And Why Is It Needed Tax Havens The Guardian

How Would A Global Minimum Tax Work And Why Is It Needed Tax Havens The Guardian

It is hoped that this would eliminate incentives to offshore investment and stop the so-called race to the bottom where countries compete for multinationals business by reducing corporate tax rates.

Global minimum business tax. The Call for a Minimum Global Corporate Tax Yellen wants to help the US. Thornton Chartered Financial Planners is the registered business name of Thornton Associates Ltd. In a speech to the Chicago Council on Global Affairs US.

The call for a worldwide minimum corporate tax rate of as high. 1 day agoMuch of Europe has applauded President Bidens proposals for global tax reform. Tax evasion is common practice for multinationals around the world.

Corporate tax rate to 28 so it has proposed a global minimum of 21 - double the rate on the. Global minimum tax rates are being hotly debated. The global minimum tax would apply to companies foreign earnings meaning that countries could still establish their own corporate tax rate at home.

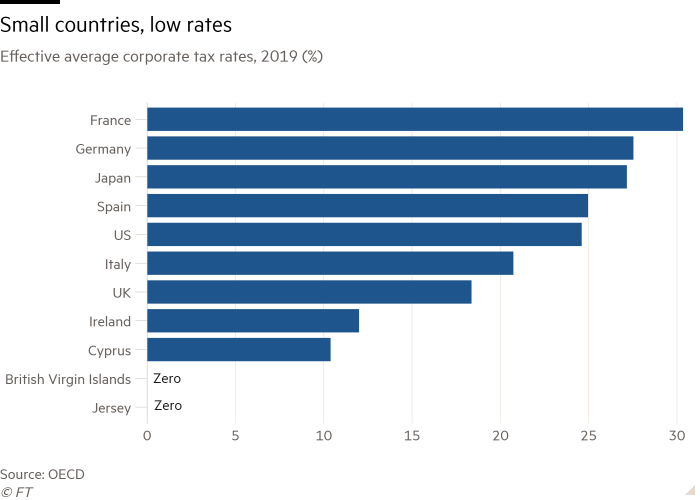

A global minimum on corporate profits tax could put an end to this. Treasury Secretary Janet Yellen has called for a minimum corporate income tax that would be shared by countries all over the world. According to the right-leaning Tax Foundation the international average corporate tax rate is about 24.

Council of Economic Advisers chair Cecilia Rouse pushed for a global minimum tax on corporations to counteract President Bidens proposed corporate tax rate hike. The Biden administrations plan seeks to establish a global minimum corporate tax rate of 21. With a global minimum rate of 15 in effect Country A would top up the tax and collect another 4 of the companys profit from Country B -- representing the difference between Country Bs.

According to microeconomic theory the tax incidence depends on the elasticity of supply and demand that is the responsiveness of quantities supplied and demanded to a change in price. New global minimum tax rates and why the Isle of Man could be affected. The Biden administration wants to raise the US.

That increase would come just four years after former President Donald Trump slashed the. Yellen called for a global minimum corporate tax on Monday to prevent companies from evading taxes as the Biden administration focuses on raising revenue in. Now that we know the Biden administrations ideal rate for a global minimum corporate tax 21 its a bit easier to look at what that rate might mean particularly for developing countries.

Under the administrations proposal the corporate tax rate would climb to 28 from 21. Treasury Secretary Janet L. However it is unclear whether firms or consumers will bear the costs.

Recently Treasury Secretary Janet Yellen unveiled a new proposal to implement a global minimum tax on corporations to prevent these vast businesses from shopping around for the lowest rate. This would be in addition to raising the corporate tax rate to 28. Provided by MidAmerica Financial Resources.

A global minimum tax establishes a system under which a company from a specific country will pay at least a certain percentage of its profits in taxes. We do have one of the lowest corporate tax rates in the developed world. Ms Yellen has said a global minimum tax on companies is necessary to stop a 30-year race to the bottom which has seen countries slash.

In fact a global minimum rate of 21 per cent proposed by the US will be disastrous for Singapore given its current corporate tax rate of 17 per cent.

Us Treasury S Yellen Calls For Global Minimum Corporate Tax

Us Treasury S Yellen Calls For Global Minimum Corporate Tax

Biden Says Higher Corporate Tax Won T Hurt Economy

Biden Says Higher Corporate Tax Won T Hurt Economy

Yellen Pushes Global Minimum Tax As White House Eyes New Spending Plan The Washington Post

Yellen Pushes Global Minimum Tax As White House Eyes New Spending Plan The Washington Post

Janet Yellen Calls For Global Minimum Corporate Tax Financial Times

Janet Yellen Calls For Global Minimum Corporate Tax Financial Times

Sunak Urged To Back Biden Corporate Tax Plan Worth 13 5bn A Year Tax And Spending The Guardian

Sunak Urged To Back Biden Corporate Tax Plan Worth 13 5bn A Year Tax And Spending The Guardian

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg) Countries With The Highest Lowest Corporate Tax Rates

Countries With The Highest Lowest Corporate Tax Rates

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

Yellen To Push For Global Minimum Tax On Corporations

Yellen To Push For Global Minimum Tax On Corporations

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

Europe S Low Tax Nations Braced For Struggle Over Us Corporate Tax Plan Financial Times

Europe S Low Tax Nations Braced For Struggle Over Us Corporate Tax Plan Financial Times

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Can A Global Minimum Corporate Tax Be A Game Changer For India

Can A Global Minimum Corporate Tax Be A Game Changer For India

Janet Yellen Calls For Global Minimum Corporate Tax Financial Times

Janet Yellen Calls For Global Minimum Corporate Tax Financial Times

Yellen To Push For Global Minimum Tax On Corporations

Yellen To Push For Global Minimum Tax On Corporations

Janet Yellen Calls For Single Minimum Corporate Tax Around The World Npr

Janet Yellen Calls For Single Minimum Corporate Tax Around The World Npr

Chart Global Corporation Tax Levels In Perspective Statista

Corporations Avoid Tax Bills Despite Reform Efforts The Washington Post

Corporations Avoid Tax Bills Despite Reform Efforts The Washington Post

Global Corporate Tax Deal Edges Closer As France Germany Support Us Approach

Global Corporate Tax Deal Edges Closer As France Germany Support Us Approach

Post a Comment for "Global Minimum Business Tax"