Global Minimum Tax Increase

This would apply to the largest and most profitable businesses numbering around 100 with the suggestion that the minimum rate to be applied to be 21 and be. Council of Economic Advisers chair Cecilia Rouse pushed for a global minimum tax on corporations to counteract President Bidens proposed corporate tax rate hike.

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

One pillar of the groups work is focused on a nonbinding global minimum tax.

Global minimum tax increase. The organizations calculations rely on most countries adopting a 125 minimum rate and the United States retaining its current global minimum tax regime which includes a. Corporate tax rate to 28 from 21 partially undoing the Trump administrations cut from 35 in its 2017 tax legislation. Along with the increase in the US.

Biden has called for increasing the domestic corporate tax rate from 21 to 28 and he is also seeking a doubling of the current 105 minimum tax on foreign. 13 hours ago4D Chess. The global minimum push is coming alongside the Bidens administration to raise taxes at home.

Biden and the OECD Pushing Global Minimum Tax to Increase Business Tax Burdens March 16 2021 by Dan Mitchell For the past couple of decades Ive been warning over and over and over and over again that politicians want to curtail tax competition so that it will be easier for them to increase tax burdens. In the model suggested by OECD and US President Joe Biden the home country of a corporation could set an additional tax on those profits for which the corporate taxes are paid to countries tax havens whose. This would be in addition to raising the corporate tax rate to 28.

Yellen stated Together we can use a global minimum tax to make sure the global economy thrives based on a more level playing field in the taxation of multinational corporations and spurs innovation growth and prosperity. In 2017 the US cut its corporate tax rate to 21 from 35 but Biden proposed raising it back to 28 in his infrastructure package. Tax on overseas corporate income and to make it harder for companies to shift earnings offshore.

Under proposals unveiled today as part of a new 2tn infrastructure plan the White House said the Presidents tax reforms would increase the minimum tax. The Treasury Secretary is also floating a global minimum tax on corporations which would reduce the tax competition among countries that is a rare discipline on political tax. To US lawmakers Ms Yellen has made the case that establishing a global minimum tax would allow the US to remain competitive despite that increase.

The new US. Corporate tax rate at 3234 and make it the highest in the world. President Joe Biden has proposed hiking the US.

Treasury Secretary Janet Yellen called for a global minimum corporate tax rate on Monday a pitch that comes as the Biden administration begins to. The global minimum push is coming alongside the Bidens administration to raise taxes at home. Recently Treasury Secretary Janet Yellen unveiled a new proposal to implement a global minimum tax on corporations to prevent these vast businesses from shopping around for the lowest rate.

Secretary of Treasury Janet Yellen has garnered this weeks tax spotlight with her support and request for the world to support a minimum global corporate income tax. Biden also wants to set a minimum US. This would be in addition to raising the corporate tax rate to 28.

The work comes as the Biden administration is looking at including tax. Tax we propose to raise the global minimum tax and to close tax loopholes that allow American corporations to. The Biden plan tax hike calls for raising the corporate rate to 28 percent from 21 percent proposes a new global minimum tax on American businesses and.

This proposed global minimum tax. Setting a global minimum rate for corporate taxes would help to eradicate tax havens and increase corporate tax revenues globally. In 2017 the US cut its corporate tax rate to 21 from 35 but Biden proposed raising it.

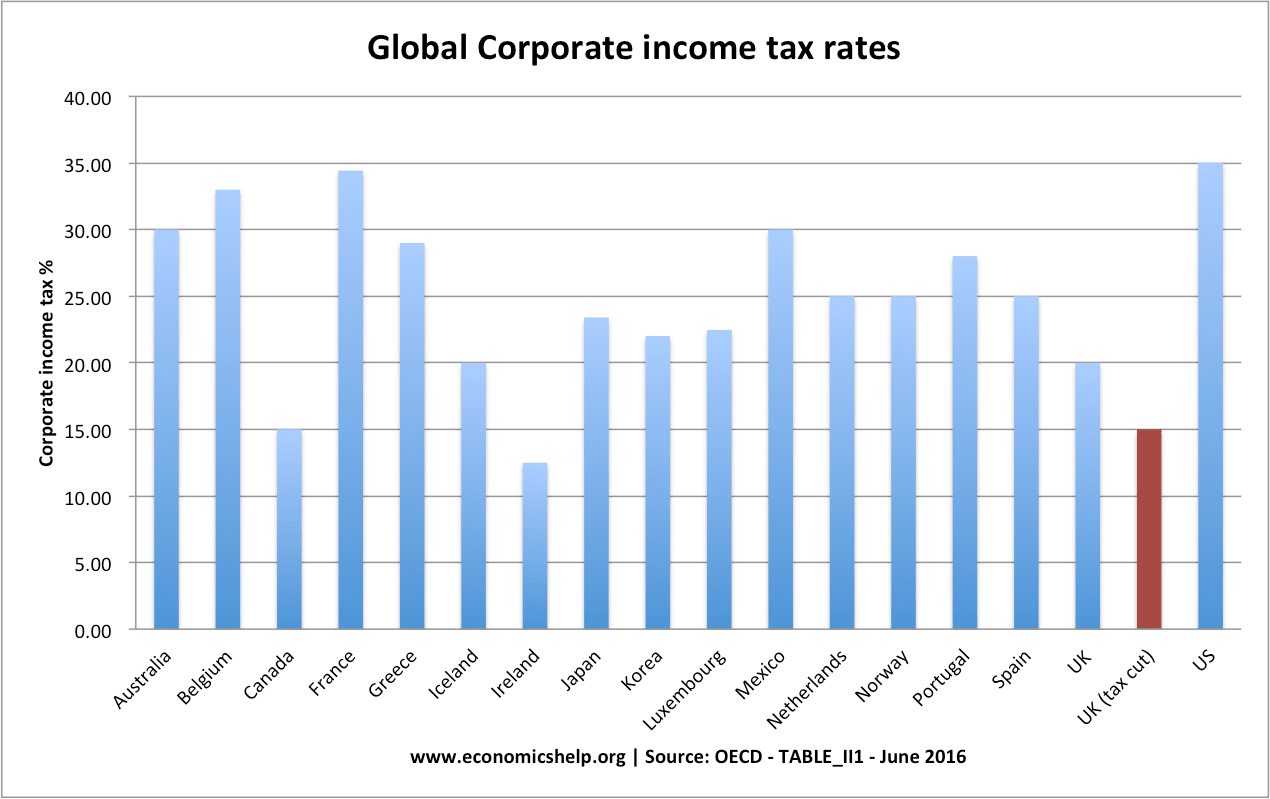

According to the right-leaning Tax Foundation the international average corporate tax rate is about 24. Recently Treasury Secretary Janet Yellen unveiled a new proposal to implement a global minimum tax on corporations to prevent these vast businesses from shopping around for the lowest rate. Wallace confronted her with the fact that the proposed increase would put the US.

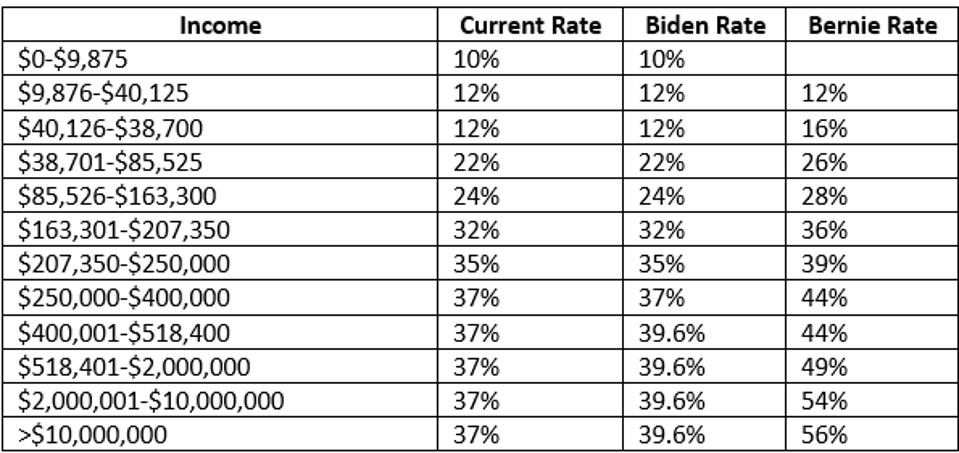

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

Does Cutting Corporate Tax Rates Increase Revenue Economics Help

Does Cutting Corporate Tax Rates Increase Revenue Economics Help

Evolution Of Tax System Tax Concessions On Home Loans In India Home Loans Loan System

Evolution Of Tax System Tax Concessions On Home Loans In India Home Loans Loan System

Average Tax Rate What Is The Average Tax Rate Tax Foundation

Average Tax Rate What Is The Average Tax Rate Tax Foundation

Doing Business In The United States Federal Tax Issues Pwc

Doing Business In The United States Federal Tax Issues Pwc

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Can A Global Minimum Corporate Tax Be A Game Changer For India

Can A Global Minimum Corporate Tax Be A Game Changer For India

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Post a Comment for "Global Minimum Tax Increase"