How Much Is Life Insurance Payout Taxed

If you surrender the policy and receive a cash value of 13400 your insurer reports 1400 or the cash. 844 786-8229 email protected.

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Tax Reporting Rules for Life Insurance Payouts.

How much is life insurance payout taxed. How do you pay the taxes. But any interest gained from a life insurance payout or any money you withdraw from a cash value life insurance policy while the insured person is still alive is counted as income and taxed as such. 40000 Taxable Income.

Life insurance payouts are totally income tax freeso in most cases youll get the full amount of the payout. The amount of the cash surrender value above your premiums is the interest. The Canadian Revenue Agency makes receiving life insurance proceeds simple for beneficiaries when it comes to tax reporting.

If you are not listed as the owner of your life insurance policy it is not part of your estate. Permanent life insurance policies typically include a cash value which can be borrowed against and potentially used to pay the premium or purchase an annuity. The interest is income and is taxed.

Life insurance helps make sure your loved ones are taken care of in the event of your death. However any interest you receive is taxable and you should report it as interest received. The interest is income and is taxed.

For a life insurance policy your premiums are the deposit. Installment Payments Also known as a systematic withdrawal this is where the life policy pays out the death benefit in installments such as 20 of the full death benefit amount every year for five years. Since life insurance death benefits can.

Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. Essentially you can deduct a total of 35 million rand from the overall value of your estate. Annual cash value growth in.

50000 Premiums Paid. There are a lot of different options when it comes to life insurance - we can help you compare prices. If youre the beneficiary of a life insurance policy the IRS says you dont have to report the amount received as.

To avoid this tax consider setting up an irrevocable life insurance trust ILIT. 420000 X 04 40 168000 total amount owed How to Avoid the Estate Tax. Life insurance proceeds arent taxable.

Quotacy walks you through a few very specific situations when taxes will affect your payout. One of the primary upsides to life insurance is that the payout is made to your beneficiaries tax-free. For example if you paid 100 monthly for 10 years the amount of your premium is 12000.

The amount you deposit is yours and not taxed when you take it back. In most cases life insurance payouts are not taxable which is a huge benefit. Estate taxes on life insurance payouts If your estate is valued at 1158 million the IRS threshold for 2020 or more it will be subject to federal estate tax.

Life insurance benefits are not taxes. The beneficiary usually earns interest on. Any taxable elements of a life insurance payout above the iht threshold will be taxed at 40 or the current iht rate.

The cash value has the potential to grow over time and accrue interest. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. Unless tax is due on interest earnings these amounts dont have to be reported as taxable income on a tax return.

If you have less than 50000 of group and supplemental term life insurance you wont be taxed on the value of it. However any coverage over 50000 will be assigned a fair market value by the IRS which is determined by your age. Typically life insurance payouts are not taxed.

See Topic 403 for more information about interest. But you might have to pay other types of taxes. So technically in this situation the proceeds of the life insurance would be taxed estate taxes only not income tax and the amount owed would be 168000.

This applies to life insurance payouts too. Typically life insurance payouts are not taxed. A life insurance payoutthe kind thats distributed after the insured person diesisnt taxed.

A life insurance death benefit or other money from a life insurance policy is usually tax-free but there are several times when the IRS will want to tax pol.

Is Life Insurance Taxable For Beneficiaries Credit Karma Tax

Is Life Insurance Taxable For Beneficiaries Credit Karma Tax

Taxes Are Life Insurance Premiums Tax Deductible Quotacy

Taxes Are Life Insurance Premiums Tax Deductible Quotacy

How Much Do You Know About Life Insurance Pinfographics Life Insurance Awareness Month Life Insurance Quotes Life Insurance Facts

How Much Do You Know About Life Insurance Pinfographics Life Insurance Awareness Month Life Insurance Quotes Life Insurance Facts

Is Life Insurance Taxable Forbes Advisor

Is Life Insurance Taxable Forbes Advisor

Are Life Insurance Proceeds Taxable Cases In Which Life Insurance Is Taxed Valuepenguin

Do I Have To Pay Taxes On A Life Insurance Payout

Do I Have To Pay Taxes On A Life Insurance Payout

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Quotes 250k Of Coverage From 8 Mth Smartasset Com Life Insurance Quotes Retirement Calculator Life Insurance Policy

Life Insurance Quotes 250k Of Coverage From 8 Mth Smartasset Com Life Insurance Quotes Retirement Calculator Life Insurance Policy

Life Insurance 8 Terms Everyone Should Know Life Insurance Policy Life Insurance Whole Life Insurance

Life Insurance 8 Terms Everyone Should Know Life Insurance Policy Life Insurance Whole Life Insurance

Understanding Whole Life Insurance Dividend Options

Understanding Whole Life Insurance Dividend Options

Life Insurance Tips Info You Must Know While Life Insurance Proceeds Are Exempt From Income Tax Life Insurance Policy Cheap Pet Insurance Insurance Marketing

Life Insurance Tips Info You Must Know While Life Insurance Proceeds Are Exempt From Income Tax Life Insurance Policy Cheap Pet Insurance Insurance Marketing

Using Cash Value Life Insurance For Retirement Savings

Using Cash Value Life Insurance For Retirement Savings

Can I Buy Life Insurance For My Child Taxation Of Life Insurance Proceeds In Buy Sell Agreements Why Buy Insurance In Blackjack How To Insure A Car Same Day A Life Insurance

Can I Buy Life Insurance For My Child Taxation Of Life Insurance Proceeds In Buy Sell Agreements Why Buy Insurance In Blackjack How To Insure A Car Same Day A Life Insurance

/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg) Understanding Taxes On Life Insurance Premiums

Understanding Taxes On Life Insurance Premiums

Do I Need To Pay Taxes On A Life Insurance Payout

Do I Need To Pay Taxes On A Life Insurance Payout

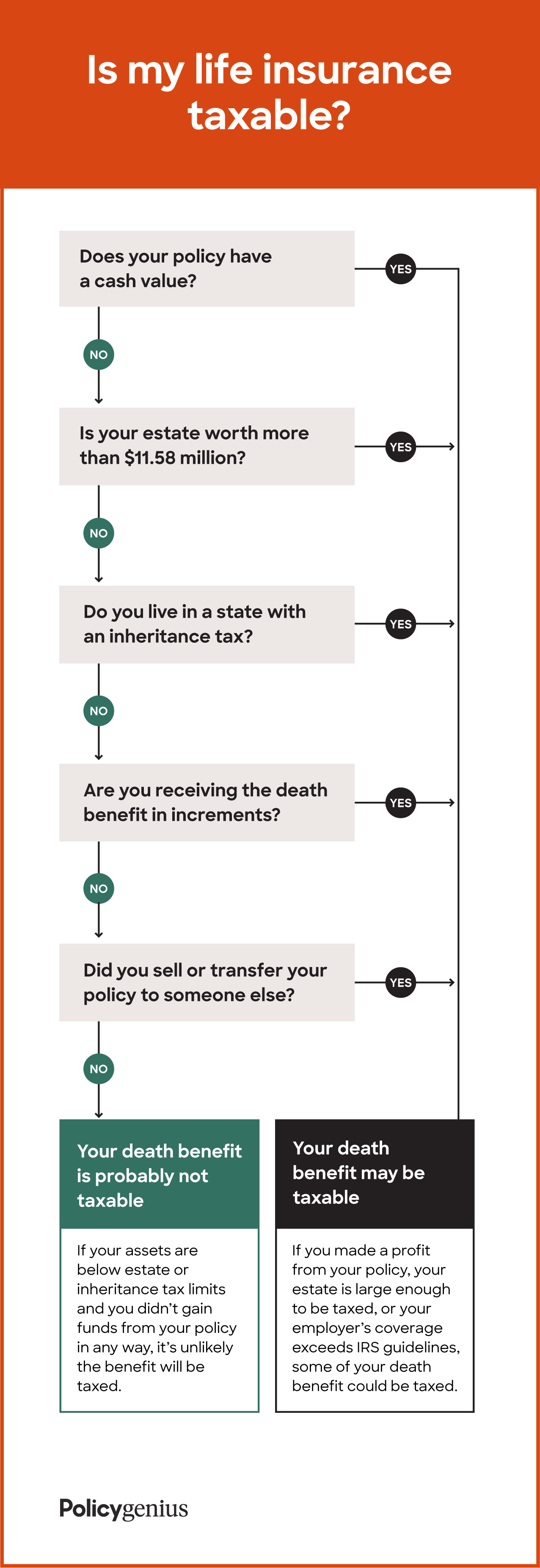

Is Life Insurance Taxable Policygenius

Is Life Insurance Taxable Policygenius

The Times Group Life Insurance Facts Life Insurance

The Times Group Life Insurance Facts Life Insurance

Keyman Insurance Life Insurance Corporation Life Insurance Agent Business Insurance

Keyman Insurance Life Insurance Corporation Life Insurance Agent Business Insurance

Post a Comment for "How Much Is Life Insurance Payout Taxed"