Global Minimum Tax Oecd

The Biden administration wants to raise the US. President Joe Bidens proposal to set a minimum global corporation tax at 21 is gaining momentum with the official running international talks on the matter saying that an agreement could settle near that rate.

The OECD is trying to broker an agreement among about 140 countries to write new rules addressing how digital firms are taxed and to create a minimum global levy.

Global minimum tax oecd. The message reinforced President Joe Bidens recent call for raising the minimum tax already in place on US. The G-20 is gearing up for a meeting to. The analysis also shows that a further USD 100 billion could be redistributed to market jurisdictions through Pillar One plans to ensure a fairer international tax.

Up to 4 of global corporate income tax CIT revenues or USD 100 billion of revenue gains annually could result from implementation of the global minimum tax under Pillar Two. May 5 2021 854 AM PDT. Companies profits from their global operations in.

Discussions within the OECD about a global minimum tax amid broader negotiations over cross-border tax rules are advancing and while theres still not widespread agreement on. While negotiations are ongoing it is worth considering a design for the minimum tax that would be neutral toward investment decisions and minimize complexity and compliance costs. In 2017 the US cut its corporate tax rate to 21 from 35.

A global minimum rate for corporate tax would decrease tax competition which is detrimental to public economies and causes inequality. Global minimum tax rates are being hotly debated. On 12 October 2020 the OECD released for public consultation updated reports on its two-pillar proposal to address the tax challenges of the digitalisation of the economy.

With thanks to Paul from tax consultants Hotchkiss Associates here are his views. Global Minimum Tax Near 21 Is Feasible OECD Official Says. OECD Minimum Tax Rate Hurts the US.

The OECD previously estimated that a global minimum. The global minimum push is coming alongside the Bidens administration to raise taxes at home. European Union should support OECD United States and others in adopting the minimum level.

To address the remaining challenges of base erosion and profit shifting BEPS by large multinational enterprises the OECD envisages a global minimum level of company taxation and top-up taxation by countries up to that level where other countries do not adhere to the new standard. Before the Biden proposal the Organisation for Economic Cooperation and Development OECD said a global minimum rate could boost the global tax take by US100 billion. The Pillar One proposal focuses on new nexus and profit allocation rules for certain business models whereas the Pillar Two proposal pursues more broadly a global minimum effective taxation.

The Biden administrations plan has turbocharged negotiations at the Organization for Economic Cooperation and Development. Corporate tax rate to 28 so it has proposed a global minimum of 21 - double the rate on the current GILTI tax. The work at the Organisation for Economic Co-Operation and Development OECD has included plans to propose a global minimum tax.

The nations negotiating the global tax rate have set a summer deadline for striking a deal. The organizations calculations rely on most countries adopting a 125 minimum rate and the United States retaining its current global minimum tax regime which includes a. BRUSSELS Reuters - The European Commission backed on Tuesday a call from US.

Last year the Organization for Economic Cooperation and Development OECD announced its two-pillar proposal to pursue the goals of transferring tax rights between nations targeting profits of larger companies and multinational corporations and instituting a cross-border minimum tax rate. Treasury Secretary Janet Yellen for a global minimum corporate tax but. The eagle-eyed amongst you will have seen last week was the first time that the OECD minimum global corporate tax rate featured in the IOM press.

Countries have set a summer target.

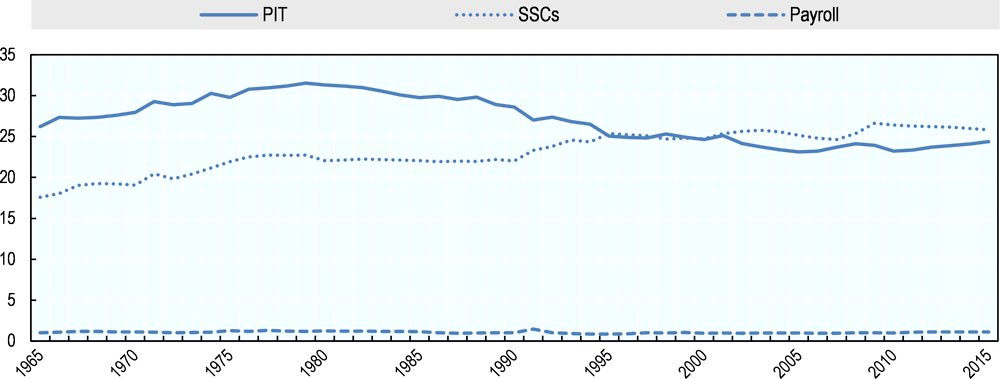

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

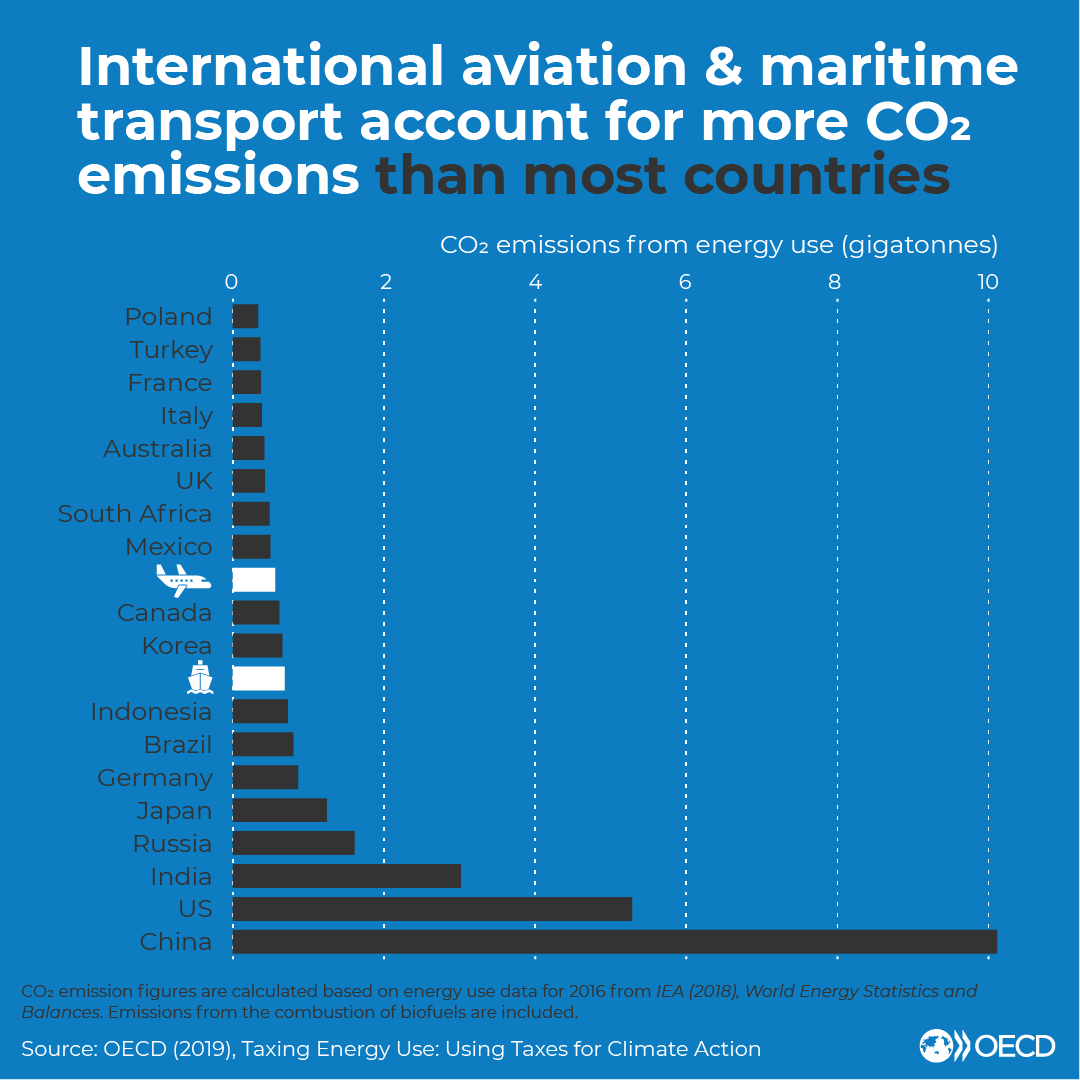

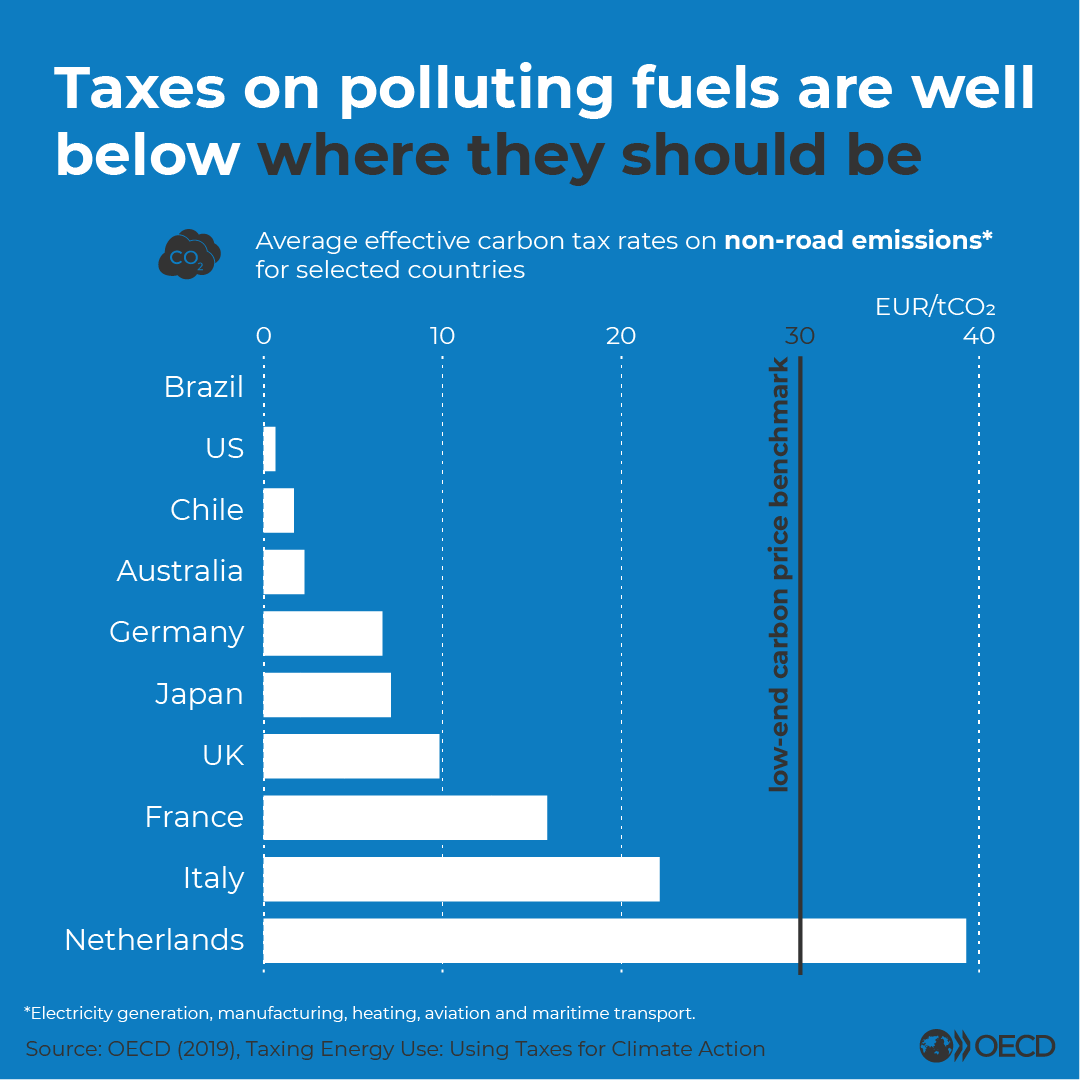

Taxing Energy Use 2019 Using Taxes For Climate Action En Oecd

Taxing Energy Use 2019 Using Taxes For Climate Action En Oecd

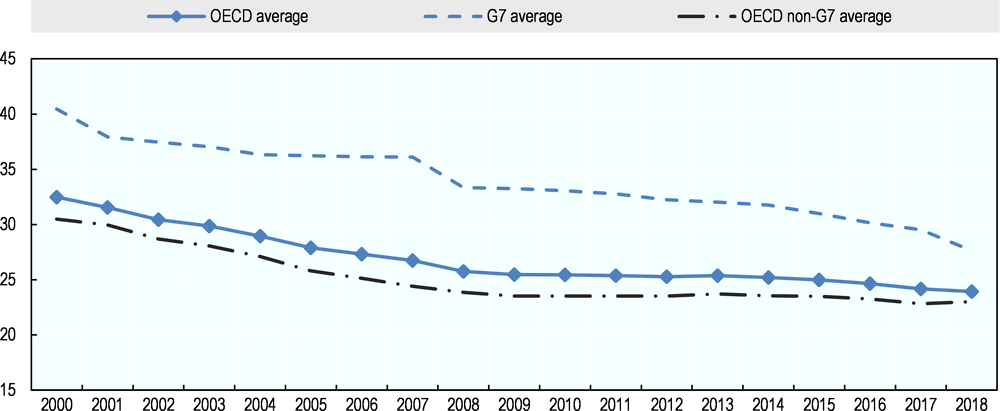

Corporate Tax Statistics Database Oecd

Corporate Tax Statistics Database Oecd

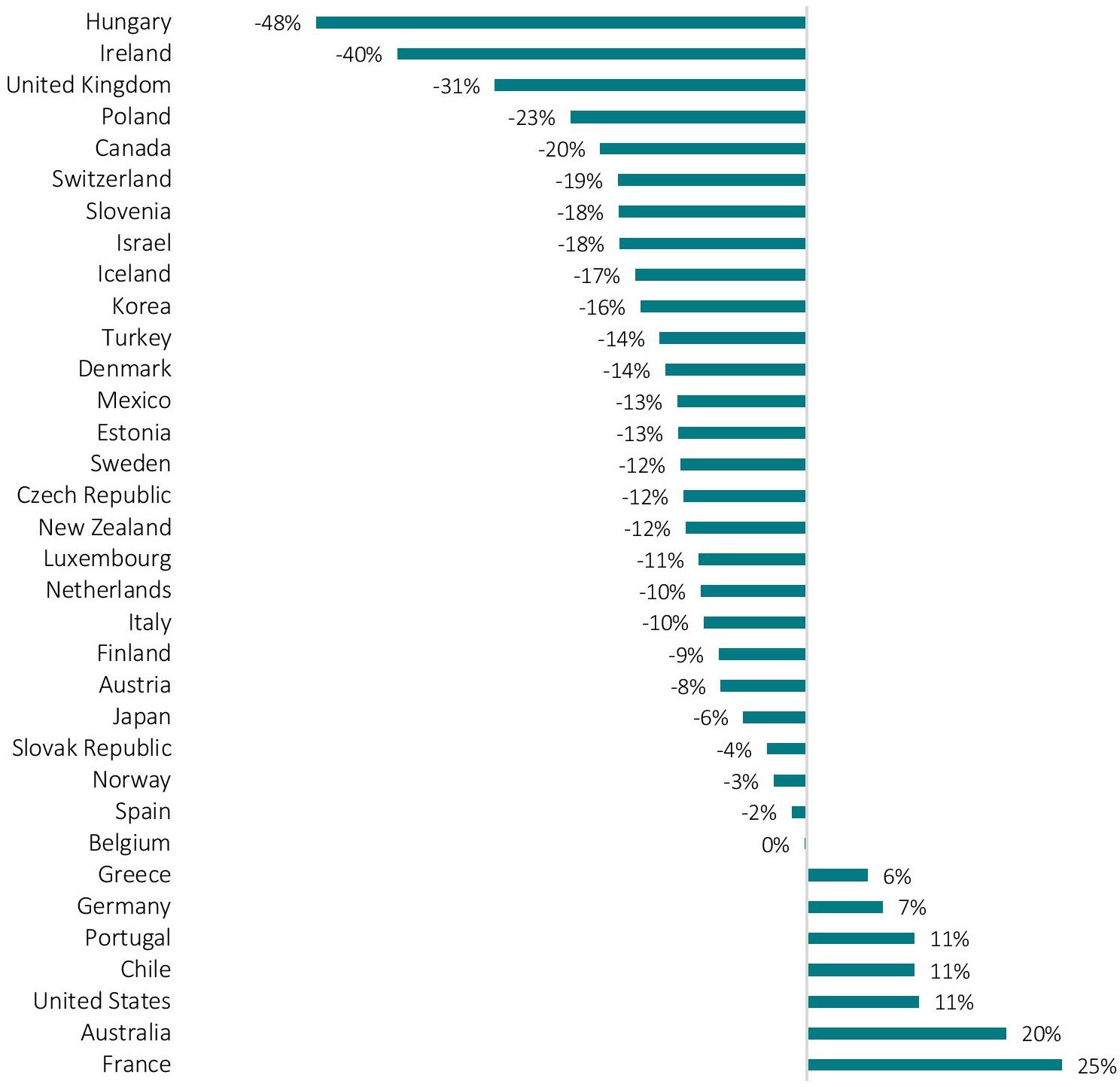

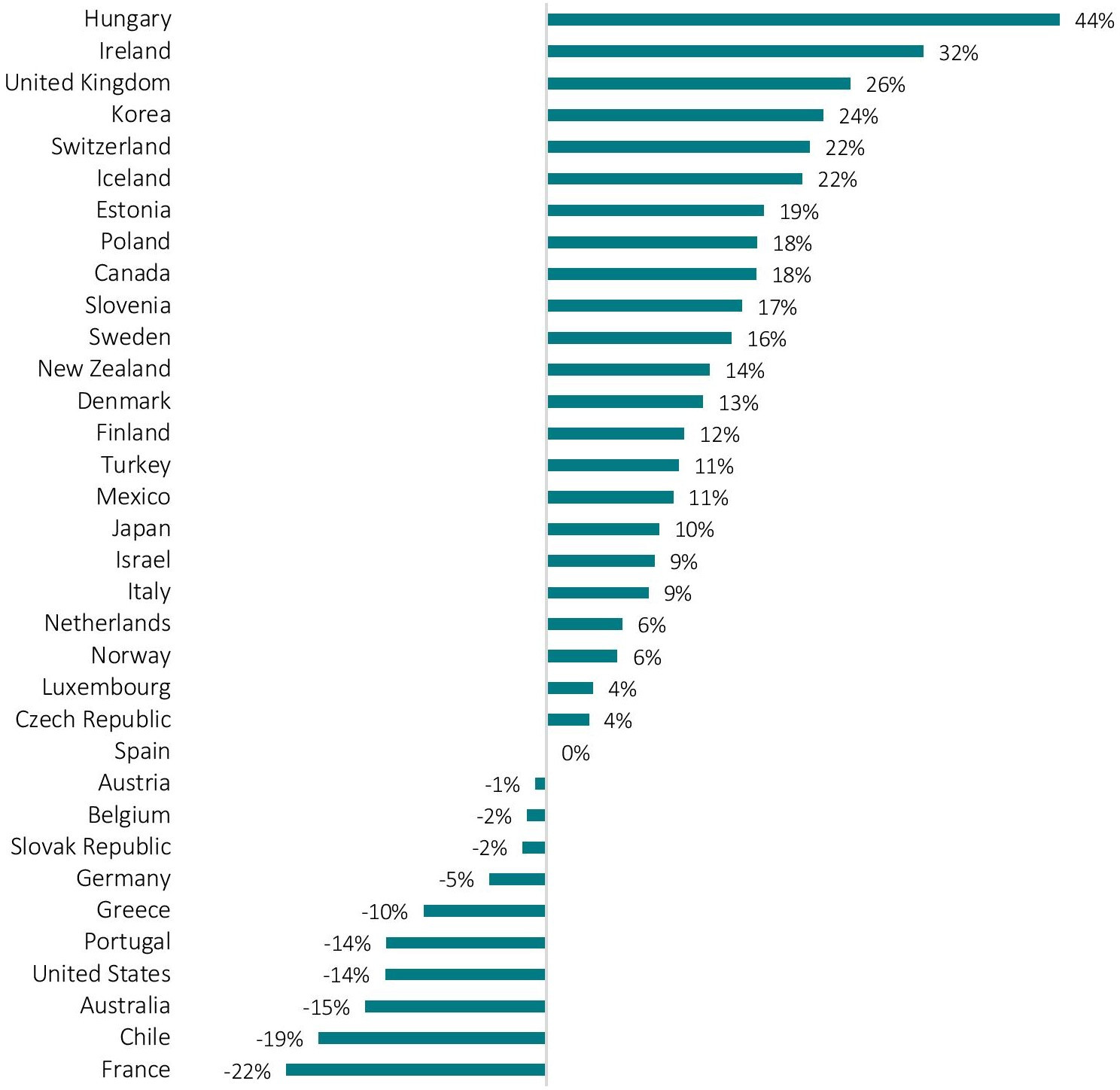

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

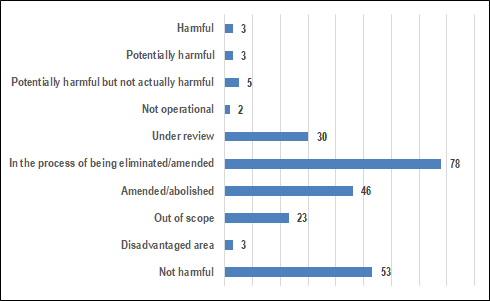

Oecd Releases Latest Results On Preferential Regimes And Moves To Strengthen The Level Playing Field With Zero Tax Jurisdictions Oecd

Oecd Releases Latest Results On Preferential Regimes And Moves To Strengthen The Level Playing Field With Zero Tax Jurisdictions Oecd

Taxing Energy Use 2019 Using Taxes For Climate Action En Oecd

Taxing Energy Use 2019 Using Taxes For Climate Action En Oecd

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

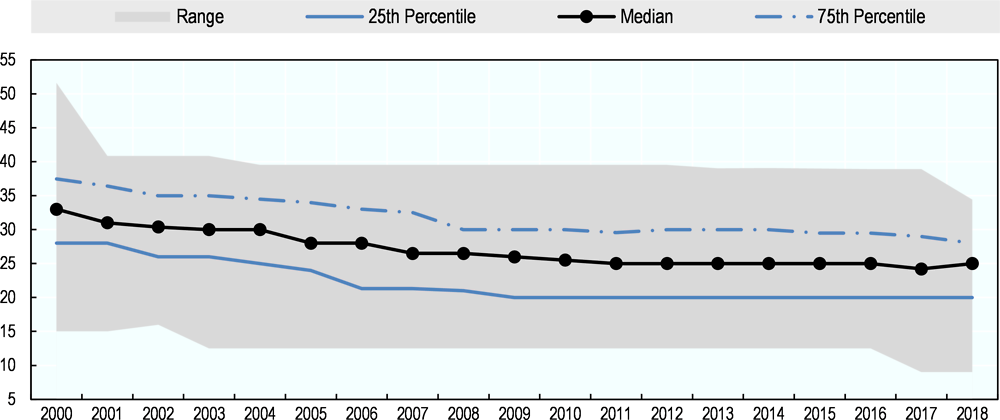

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

Corporate Tax Statistics Database Oecd

Corporate Tax Statistics Database Oecd

Total Tax Revenue Us Taxes Are Low Relative To Those In Other Developed Countries In 2014 Us Taxes At All Le Gross Domestic Product Developing Country Us Tax

Total Tax Revenue Us Taxes Are Low Relative To Those In Other Developed Countries In 2014 Us Taxes At All Le Gross Domestic Product Developing Country Us Tax

Corporate Tax Statistics Database Oecd

Corporate Tax Statistics Database Oecd

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

A Grand Bargain How The Radical Us Corporate Tax Plan Would Work Financial Times

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg) Countries With The Highest Lowest Corporate Tax Rates

Countries With The Highest Lowest Corporate Tax Rates

Around The World Covid Prompts New Look At Company Taxes Reuters

Around The World Covid Prompts New Look At Company Taxes Reuters

Around The World Covid Prompts New Look At Company Taxes Reuters

Around The World Covid Prompts New Look At Company Taxes Reuters

Oecd Oecd Life Is Good Infographic Data

Oecd Oecd Life Is Good Infographic Data

Post a Comment for "Global Minimum Tax Oecd"