Positive Effects Of Financial Globalization

See Edwards 2001 Gourinchas and Jeanne 2006 Bonfiglioli 2008 and Kose Prasad and Terrones 2009 for empirical evidence and a quantification of these effects. Globalization increases correlation between investment returns-In other words one of the benefits of investment diversification is that when one asset class such as US.

The Evidence And Impact Of Financial Globalization 1st Edition

The Evidence And Impact Of Financial Globalization 1st Edition

Developed countries by having access to foreign markets can sell their products to a different market.

Positive effects of financial globalization. Financial globalization and its effects 1 Kuala Lumpur 2016 - Luis Servén. Positive correlation between CIF and COD -- thats why net flows are less volatile than gross. For example if stocks go down then you want another investment class to go up in value to.

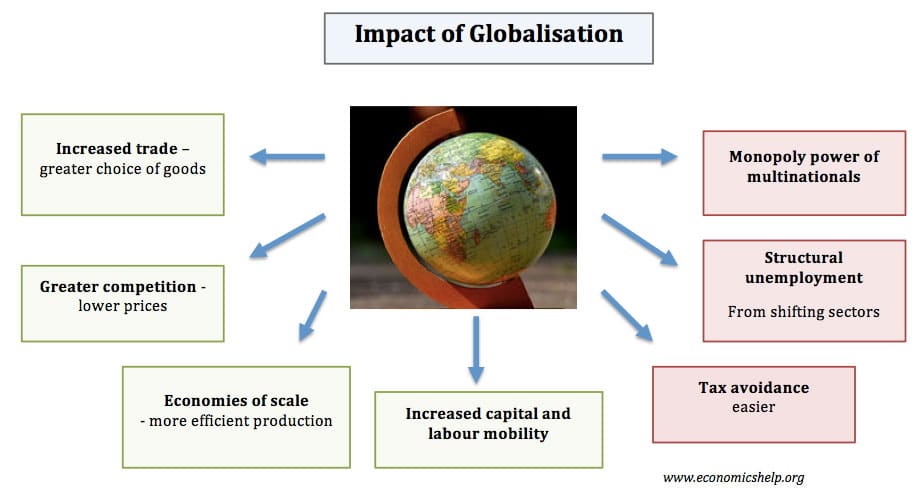

The current level of competition in the market is one obvious result of globalization. As a result access to external sources of finance by both corporations and nations has been enhanced. Traditional focus has been on net flows.

Our theory as it stands cannot account for these effects since. In this surrounding challenges of unbalanced statistics are reduced and credit is increased. There is some evidence of a threshold effect in the relationship between financial globalization and economic growth.

Positive effects on Developing countries. This means that companies can offer goods at a lower price to consumers. The average cost of goods is a key aspect that contributes to increases in the standard of living.

An advanced commercial segment infrastructure implies that debtors and creditors work in a more clear competitive and effective financial structure. Theoretical models have identified a number of channels through which interna- tional financial integration can promote economic growth in developing countries. The positive impact of economic globalisation the winners Beneficiaries of economic growth Globalisation offers increased business opportunities for both for developed and developing countries Kuepper 2013.

Stocks goes down then another asset class such as international stocks should not move in the same direction andor by the same percent. The literature has often used the term collateral effects to refer to seemingly positive effects of financial globalization on productivity. What Is the Impact of Financial Globalization on Macroeconomic Volatility.

Its the reason for the fast growth and development of these countries as people invest in these states improving their infrastructure technology and total production. Though this is good because investments have been increased due to availability of funds it has also led to increased liability. As a result financial globalization reduces adverse choice and moral threat hence improving the accessibility of credit.

Competition on a global scale leads to products and services of higher quality. Globalization has led to the formation of multinational companies and investment in other countries with high market competition. In theory financial globalization can help developing countries to better manage output and consumption volatility.

One of the significant positive effects of globalization is the growth in international business. Globalization has had numerous positive effects on some developing countries. Preliminary evidence also supports the view that in addition to sound.

Below are some positive effects of worldwide integration on developing countries. Second financial globalization leads to a better financial infrastructure what mitigates information asymmetries and as a consequence reduces problems such as adverse selection and moral hazard. Companies got access to a bigger market which in return boosts sales and the money-making process.

Flows and continued financial globalization over the medium and long term. When customers have more options to choose from their demands also tend to grow and companies have to react to these new expectations. Financial globalization advances the financial infrastructure.

Global imbalances The gains from financial globalization 2 Kuala Lumpur 2016 - Luis Servén. The beneficial effects of financial globalization are more likely to be detected when the developing countries have a certain amount of absorptive capacity. In general globalization decreases the cost of manufacturing.

Consumers also have access to a wider variety of goods. Consumers benefit too. Globalization has led to the emergence of financial markets that are effective worldwide.

Https Www Jstor Org Stable 4414133

This Chart Shows Who Gains From Globalisation World Economic Forum

This Chart Shows Who Gains From Globalisation World Economic Forum

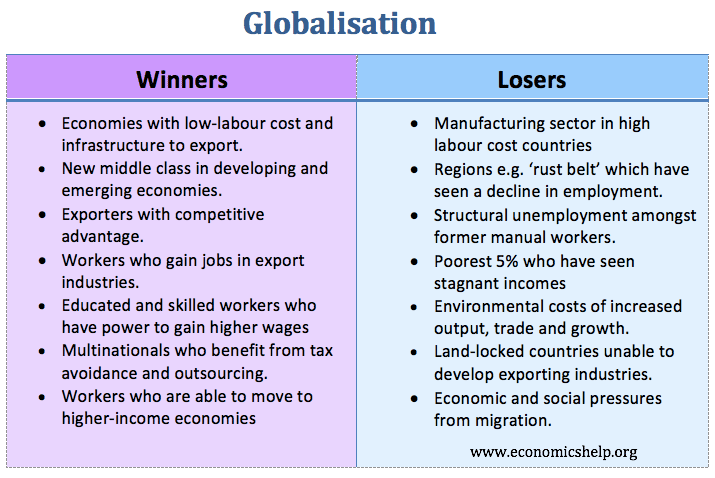

Winners And Losers From Globalisation Economics Help

Winners And Losers From Globalisation Economics Help

Globalization Positive Effects On Economy Best Image Of Economy

Globalization Positive Effects On Economy Best Image Of Economy

Unu Wider Blog The Impact Of Globalization On The World S Poor

Globalisation Essay Positive And Negative Impacts On Developing World The Writepass Journal

Globalisation Essay Positive And Negative Impacts On Developing World The Writepass Journal

Globalization Positive Effects On Economy Best Image Of Economy

Globalization Positive Effects On Economy Best Image Of Economy

Financial Globalization Beyond The Blame Game Finance Development March 2007

Financial Globalization Beyond The Blame Game Finance Development March 2007

Globalization Positive Effects On Economy Best Image Of Economy

Globalization Positive Effects On Economy Best Image Of Economy

1 Positive And Negative Aspects Of Globalization Download Table

1 Positive And Negative Aspects Of Globalization Download Table

Financial Globalization Beyond The Blame Game Finance Development March 2007

Financial Globalization Beyond The Blame Game Finance Development March 2007

What Are The Most Important Positive And Negative Aspects Of Globalization

What Are The Most Important Positive And Negative Aspects Of Globalization

Financial Globalization Beyond The Blame Game Finance Development March 2007

Financial Globalization Beyond The Blame Game Finance Development March 2007

The Positive Effects Of Globalization That We Never Talk About Effects Of Globalization Global Comparative Advantage

The Positive Effects Of Globalization That We Never Talk About Effects Of Globalization Global Comparative Advantage

The Impact Of Globalization On Wages Jobs And The Cost Of Living Management Study Hq

The Impact Of Globalization On Wages Jobs And The Cost Of Living Management Study Hq

Costs And Benefits Of Globalisation Economics Help

Costs And Benefits Of Globalisation Economics Help

Financial Globalization Beyond The Blame Game Finance Development March 2007

Financial Globalization Beyond The Blame Game Finance Development March 2007

Online Essay Help Amazonia Fiocruz Br

Online Essay Help Amazonia Fiocruz Br

Post a Comment for "Positive Effects Of Financial Globalization"