Global X Fintech Etf Fact Sheet

The firm currently manages exchange-traded funds that target Commodity Producers Developed Markets Emerging Markets Special Opportunities and Income Producers. Global X Management Company LLC serves as an advisor to the Global X Funds.

Fintech Trends Beyond Digital Payments Global X Etfs

Fintech Trends Beyond Digital Payments Global X Etfs

The Global X FinTech ETF The Global X FinTech ETF is quite concentrated with half the stocks accounting for over 81 of the total portfolio weighting.

Global x fintech etf fact sheet. Global X FinTech ETF FINX Morningstar Analyst Rating Quantitative rating as of Mar 31 2021. An investment in an ETF is subject to risks and you can lose money on your investment. The funds are distributed by SEI Investments Distribution Co.

ETFs are subject to market fluctuation and the risks of their underlying investments. Units of the ETF are. About Global X FinTech ETF The investment seeks to provide investment results that correspond generally to the price and yield performance before fees and expenses of the Indxx Global Fintech.

Fund Summary The Global X E-commerce ETF EBIZ seeks to invest in companies positioned to benefit from the increased adoption of E-commerce as a distribution model including companies whose principal business is in operating E-commerce platforms providing E-commerce software and services andor selling goods and services online. There can be no assurance that the ETF will achieve its investment objective. The ETFs portfolio is more volatile than broad market averages.

The Global X FinTech ETF FINX seeks to invest in companies on the leading edge of the emerging financial technology sector which encompasses a range of innovations helping to transform established industries like insurance investing fundraising and third-party lending through unique mobile and digital solutions. Global X Management Company LLC is a New York-based provider of exchange-traded funds that facilitates access to investment opportunities across the global markets. SIDCO 1 Freedom Valley Drive Oaks PA 19456 which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments.

The Global X FinTech Thematic ETF seeks to provide investment results that correspond generally to the price and yield performance before fees and expenses of the Indxx Global FinTech Thematic. With our partner Volt Equity our investment process begins with a first principles approach to identify those few companies poised to. Global X FinTech ETF FINX.

GXTG Global X Thematic Growth ETF KEY FEATURES Multi-Theme Solution In a single trade GXTG delivers access to multiple disruptive macro-trends arising from technological advancements changing demographics and consumer preferences or evolving needs for infrastructure and other finite resources. FINX Global X FinTech ETF KEY FEATURES High Growth Potential FINX enables investors to access high growth potential through companies that are applying technological innovations to disrupt and improve delivery of financial services. Quote Fund Analysis Performance Risk Price Portfolio Parent.

FINX Global X FinTech ETF KEY FEATURES High Growth Potential FINX enables investors to access high growth potential through companies that are applying technological innovations to disrupt and improve delivery of financial services. Global X FinTech ETF. Unlike mutual funds ETF shares are bought and sold at market price which may be higher or lower.

Detailed information regarding the specific risks of the ETF can be found in the prospectus. The sale of ETFs is subject to an activity assessment fee from 001 to 003 per 1000 of principal. XLK Technology Select Sector SPDR Fund SMH VanEck Vectors Semiconductor ETF SOXX iShares PHLX Semiconductor ETF BLOK Amplify Transformational Data Sharing ETF IGV iShares Expanded Tech-Software Sector ET CLOU Global X Cloud Computing ETF IYW iShares US.

VFIN is designed to concentrate in those few disruptive companies poised to dominate the new era of fintech and then enhance the concentrated exposures with options. FINX MSCI ESG Analytics Insight Global X FinTech ETF has an MSCI ESG Fund Rating of A based on a score of 587 out of 10. Global X FinTech ETF.

ETFs are subject to management fees and other expenses. Technology ETF View More Technology Equities ETFs. The Indxx Global FinTech Thematic Index invests in companies on the leading edge of the emerging financial technology sector which encompasses a range of.

The Simplify Volt Fintech Disruption ETF is not just another thematic investment product. Quote Fund Analysis Performance Risk Price Portfolio Parent Premium. Quantitative rating as of Mar 31 2021.

FINX Delayed Data from NASDAQ As of May 12 2021 0400 PM.

Fintech Trends Beyond Digital Payments Global X Etfs

Fintech Trends Beyond Digital Payments Global X Etfs

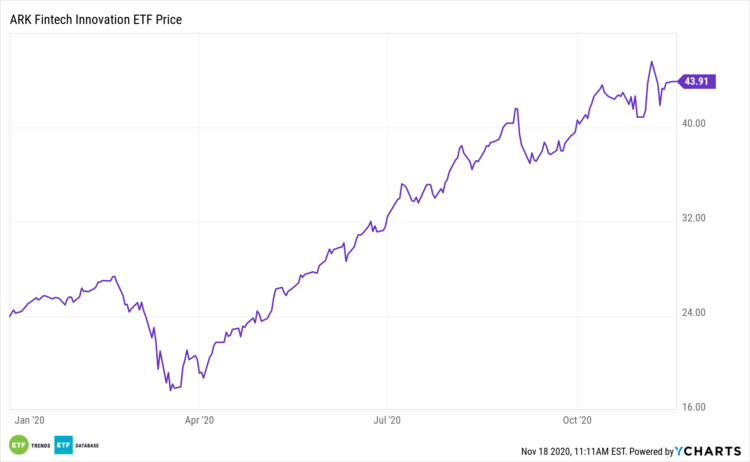

Global X Fintech Etf Or Ark Fintech Innovation Etf Nanalyze

Global X Fintech Etf Or Ark Fintech Innovation Etf Nanalyze

Global X Fintech Etf Or Ark Fintech Innovation Etf Nanalyze

Global X Fintech Etf Or Ark Fintech Innovation Etf Nanalyze

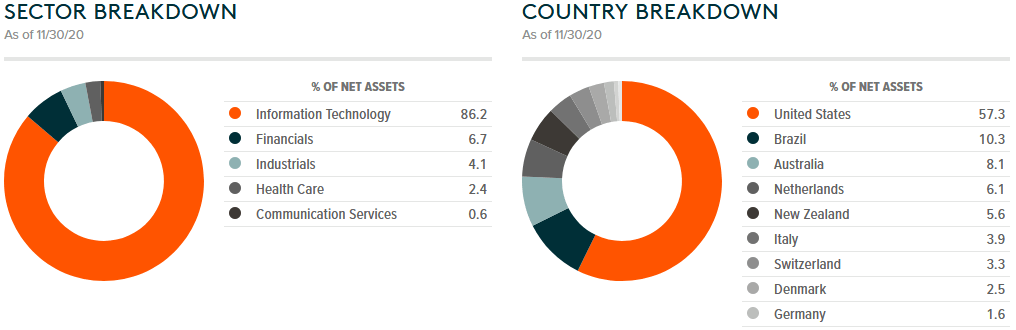

Why Fintech Is Thriving In Emerging Markets Global X Etfs

Why Fintech Is Thriving In Emerging Markets Global X Etfs

Global X Fintech Etf Or Ark Fintech Innovation Etf Nanalyze

Global X Fintech Etf Or Ark Fintech Innovation Etf Nanalyze

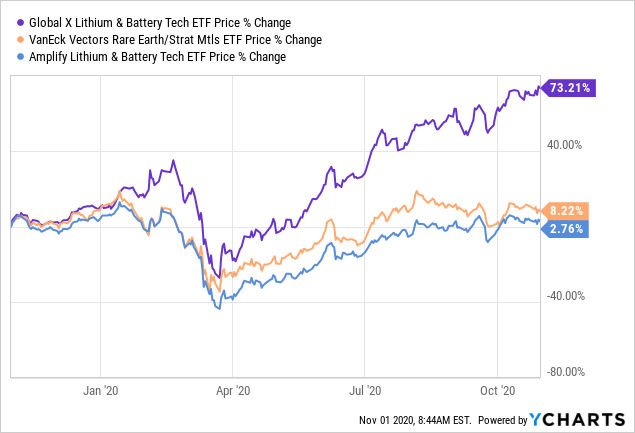

Global X Lithium Battery Tech Etf More Upside Possible Nysearca Lit Seeking Alpha

Global X Lithium Battery Tech Etf More Upside Possible Nysearca Lit Seeking Alpha

Fintech Trends Beyond Digital Payments Global X Etfs

Fintech Trends Beyond Digital Payments Global X Etfs

Fintech Trends Beyond Digital Payments Global X Etfs

Fintech Trends Beyond Digital Payments Global X Etfs

Fintech Trends Beyond Digital Payments Global X Etfs

Fintech Trends Beyond Digital Payments Global X Etfs

Why Fintech Is Thriving In Emerging Markets Global X Etfs

Why Fintech Is Thriving In Emerging Markets Global X Etfs

Crypto S Going To Be Massive For Fintech Etfs

Crypto S Going To Be Massive For Fintech Etfs

Finx Investing In Disruptive Fintech Innovators Nasdaq Finx Seeking Alpha

Finx Investing In Disruptive Fintech Innovators Nasdaq Finx Seeking Alpha

Post a Comment for "Global X Fintech Etf Fact Sheet"