International Financial Flows Definition

There has been no organized global statistics on biodiversity-related international financial resources flows. People in the country would receive as much in financial flows as they paid out in financial flows.

Pdf International Financial Flows And The Risk Taking Channel

Pdf International Financial Flows And The Risk Taking Channel

Foreign investment involves capital flows from one country to another granting the foreign investors extensive ownership stakes in domestic companies and assets.

International financial flows definition. International financial flows create global competitive pressures on CDDCs and favor specialization. That reflect an exchange of value instead of purely financial transactions. Private flows are defined as financial flows at market terms financed out of private sector resources changes in holdings of private long-term assets held by residents of the reporting country and private grants grants by non-government organisations net of subsidies received from the official sector.

Yet such local specialization runs counter to the need for diversity of economic activity to ensure diverse employment and the mutually reinforcing growth of diversity and productivity. The data show that connectedness has been on the rise in most countries and that global financial flows accounted for almost half of all global flows in 2012. In a narrow sense IFFs refer to cross-border financial transfers that have a clear connection with illegality World Bank 2016 1.

Measuring OECD Responses is the first report to measure how well countries are performing in their fight against IFFs. Independent Expert on the Effects of Foreign Debt 2016. International financial flows have exploded during the 1990s as countries particularly in the developing world have bowed to the conventional wisdom that they should remove barriers to these flows.

It reflects the level of inflows and outflows adjusted for the size of the country. All capital flows comprise just money that is a consequence of investment flows. Dominance of private capital.

When money for investment goes from one country to another is a capital flow. In recent years international capital flows have registered profound changes not only in terms of their magnitude but also their geographical patterns and composition by types of flows. FDI net outflows are the value of outward direct investment made by the residents of the reporting economy to external economies.

1 When someone imports a good or service the buyer the importer gives the seller the exporter a monetary payment just as in domestic transactions. The best available statistical information on biodiversity-related international financial resources flows is about official development assistance for biodiversity that has been compiled regularly by the Organization for Economic Cooperation and Development using the OECDDAC. This framework defines IFFs as financial flows that are illicit in origin transfer or use.

Accordingly they are receiving growing attention as a key development challenge. Research responsibilities are shared by staff economists in the seven sections listed below as well as by the. Foreign direct investment FDI takes place when a company moves in another country for the production of goods or services and.

The Division of International Finance is responsible for basic research policy analysis and reporting in the areas of foreign economic activity US. I nternational capital flows are the financial side of international trade. All flows of goods services finance people and data and communication.

The term capital flows refers to the movement of capital ie money for investment in out of countries. Bank flows foreign direct investment FDI and portfolio. 1 The broad definition of IFFs stretches the concept further by including transactions that are deemed unethical even if not illegal in the assessed jurisdiction High Level Panel on Illicit Financial Flows from Africa 2015.

Inward Direct Investment also called direct investment in the reporting economy includes all liabilities and assets transferred between resident direct investment. One is direct and the other is portfolio. FFs reduce domestic resources and tax revenue needed to fund poverty-reducing programs and infrastructure in developing countries.

External trade and capital flows and developments in international financial markets and institutions. Recognition is the process of incorporating an item in the financial statements when it meets the definition of the element and satisfies the criteria for recognition. Following are the different types forms of International Capital Flows.

Long-term financial flows such as remittances FDI and ODA can support investments that are critical for productive employment and growth in developing countries. Foreign investment can be of two types. Inside of a firm these include the flow of funds in the form of investment capital.

An important reason for this is. Capital flows refer to the movement of money for the purpose of investment trade or business operations. It draws on public data describing the situation in these policy areas and the role of donor agencies.

The term does not include money people and businesses use to purchase each others goods and services. If total exports were equal to total imports these monetary transactions would balance at net zero. As recently as 1990 financial flows into developing countries from.

FDI net inflows are the value of inward direct investment made by non-resident investors in the reporting economy. As a result three major trends have emerged. Of international financial flows is essential to assess the state of the global economic environment.

That criteria states that there is the probability of future economic benefit associated with the item that will flow to or from the entity and that the item has a cost or value. Money illegally earned transferred or used that crosses borders is the most common definition of illicit financial flows IFFs. International Capital Flows Financial flows means the inflow and outflow of capital from one nation to another nation.

IIllicit Financial Flows from Developing Countries.

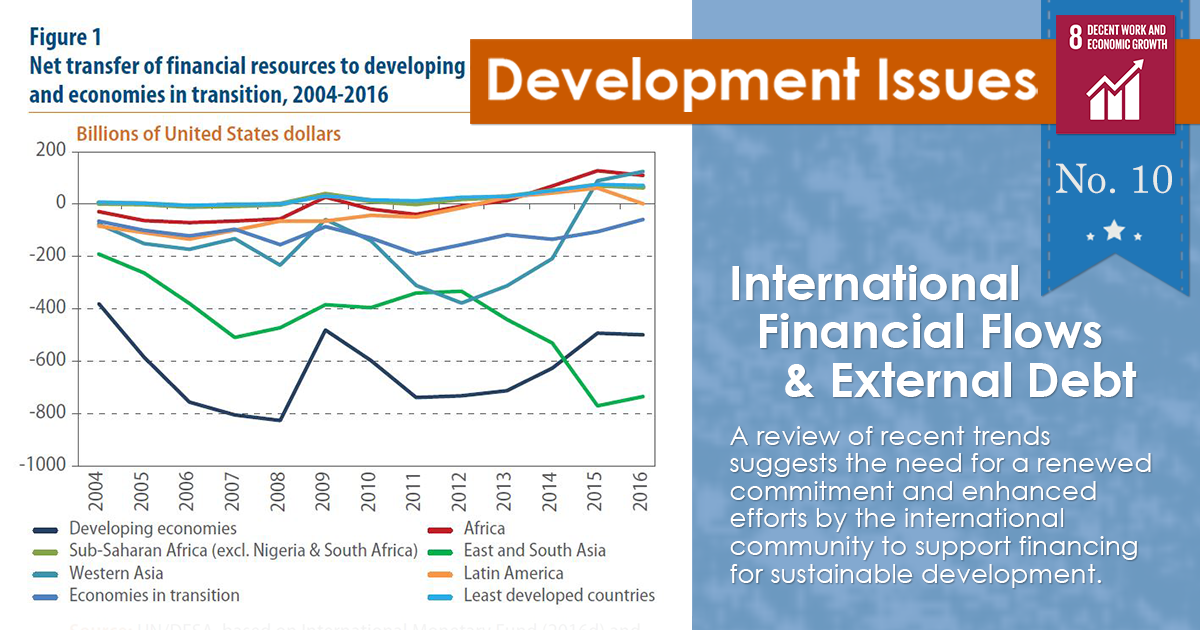

Development Issues No 10 International Financial Flows And External Debt Department Of Economic And Social Affairs

Development Issues No 10 International Financial Flows And External Debt Department Of Economic And Social Affairs

What Are Capital Flows Definition And Examples Market Business News

What Are Capital Flows Definition And Examples Market Business News

What Are Capital Flows Definition And Examples Market Business News

What Are Capital Flows Definition And Examples Market Business News

Development Issues No 10 International Financial Flows And External Debt Department Of Economic And Social Affairs

Development Issues No 10 International Financial Flows And External Debt Department Of Economic And Social Affairs

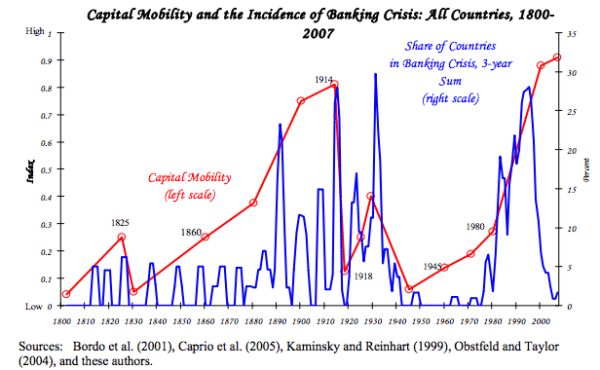

Capital Account Liberalization And Crises Ppt Download

Capital Account Liberalization And Crises Ppt Download

Development Issues No 10 International Financial Flows And External Debt Department Of Economic And Social Affairs

Development Issues No 10 International Financial Flows And External Debt Department Of Economic And Social Affairs

Development Issues No 10 International Financial Flows And External Debt Department Of Economic And Social Affairs

Development Issues No 10 International Financial Flows And External Debt Department Of Economic And Social Affairs

Development Issues No 10 International Financial Flows And External Debt Department Of Economic And Social Affairs

Development Issues No 10 International Financial Flows And External Debt Department Of Economic And Social Affairs

Https Www Oecd Ilibrary Org International Financial Flows 5kmftq44m5tj Pdf

Capital Mobility And Immobility Economics Help

Capital Mobility And Immobility Economics Help

Capital Flows Overview Types Objectives Of Restrictions

Capital Flows Overview Types Objectives Of Restrictions

Https Www Un Org Esa Ffd Wp Content Uploads 2017 02 Illicit Financial Flows Conceptual Paper Ffdo Working Paper Pdf

Pdf International Financial Flows And The Risk Taking Channel

Pdf International Financial Flows And The Risk Taking Channel

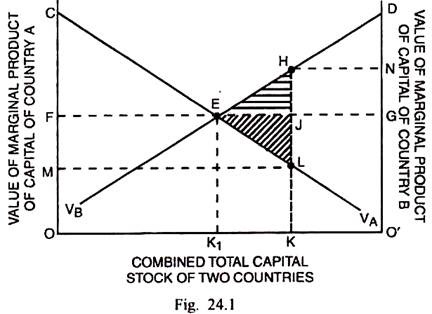

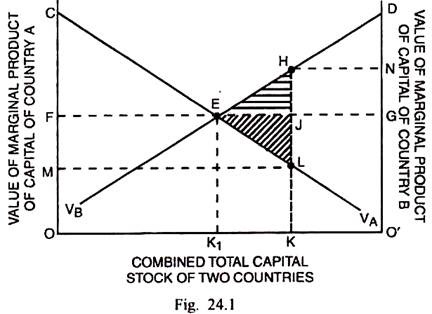

International Capital Movements Meaning And Effects Economics

International Capital Movements Meaning And Effects Economics

International Financial Flows In The New Normal Key Patterns And Why We Should Care Springerlink

International Financial Flows In The New Normal Key Patterns And Why We Should Care Springerlink

The Global Capital Flows Cycle And Its Drivers Vox Cepr Policy Portal

The Global Capital Flows Cycle And Its Drivers Vox Cepr Policy Portal

International Capital Movement Meaning International Capital Movement Or Flows Refers To The Outflow And Inflow Of Capital From One Country To Another Ppt Download

International Capital Movement Meaning International Capital Movement Or Flows Refers To The Outflow And Inflow Of Capital From One Country To Another Ppt Download

Post a Comment for "International Financial Flows Definition"